Implications of the Russo-Ukrainian War on Kazakhstan’s Oil Exports and European Energy Markets

By Anna Belcikova | 26 January 2026

Summary

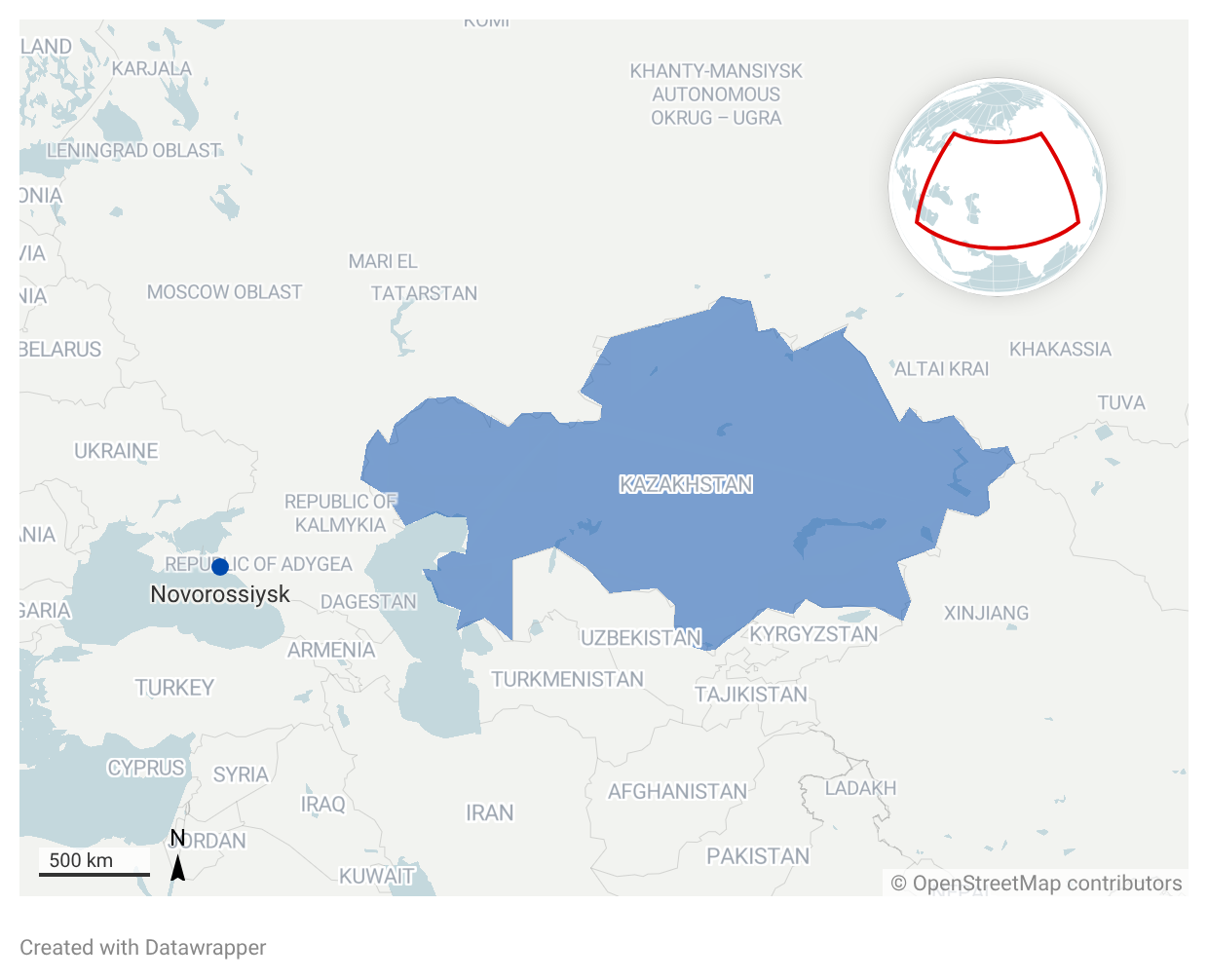

Last week, 3 oil tankers were struck by drones as they were approaching the Russian Novorossiysk port to load Kazakh oil. It is the most recent incident amongst a series of security disruptions to critical transit infrastructure.

The attacks undermine the stability of European energy markets, causing a surge in prices. Additionally, it poses negative domestic economic implications for Kazakhstan, the potential infrastructural bottleneck for oil exports representing a structural vulnerability.

The attacks will likely push Kazakhstan to reduce its reliance on Russian transit routes such as the Caspian Pipeline Consortium (CPC), and to continue diversifying its economy away from raw materials like crude oil.

Context

On 13 January, 3 oil tankers were struck by drone attacks in the Novorossiysk region, as ships waited to load Kazakh oil. The incident remains unattributed as no parties admitted responsibility. The latest attacks represent a continuation of earlier strikes on maritime infrastructure, in connection with the Russo-Ukrainian war. Attacks in this region pose serious implications, as it is a crucial node of the Kazakh oil supply chain, serving as a reliable alternative to Russian oil. As a result, Kazakhstan’s oil exports are increasingly being exposed to heightened security risks, also threatening Europe’s oil market and overall energy security. In addition to the international economic and geopolitical implications, there are significant domestic economic implications in terms of reduced productivity and output.

Implications

From an international perspective, such disruptions threaten the stability of Europe’s oil market and energy security, as prices surged following the attack. This is due to Europe’s dependence on Kazakhstan as a Russian alternative, with the CPC playing a crucial role in terms of Kazakh oil reaching global markets. Approximately 80% of the country’s oil exports travel through this pipeline, with its capacity being estimated at carrying 1.3m barrels per day, underlining its importance in the supply chain. Furthermore, Kazakhstan is considered Europe’s third largest oil exporter, accounting for more than 12% of the region’s supplies. The spillover effect of airstrikes on Kazakh energy facilities and related transportation will also likely impact Europe. This is because past disruptions and heightened risk perceptions are likely to push logistics and risk-management costs up, which in turn will raise oil prices. As a result, the European energy market will remain sensitive to price volatility from shocks related to the ongoing war, with a high likelihood of prices rising if disruptions persist. This in turn has the potential to reinforce inflationary pressures across the region.

Simultaneously, these attacks and the region's general instability pose significant economic and strategic implications for Kazakhstan, as crude oil is one of its largest exports. For example, data shows that past strikes on loading points last year inhibited national oil production, with output falling by an estimated 6%. This is complemented by a decrease in export levels, due to infrastructural damage limiting operating capacity. Furthermore, despite being neutral in the conflict, the drone attacks highlight how Kazakhstan’s control over its own exports is structurally limited, with the country bearing the costs of escalation. This could potentially put pressure on its multi-vector foreign policy, as Russia remains a key transit point, thus maintaining leverage over export flows.

In conclusion, the recent attacks represent the extent of the spill-over effect from the Russo-Ukrainian War, instability in strategically significant locations such as Novorossiysk impacting a wide range of stakeholders beyond the immediate conflict.

Forecast

Short-term (Now - 3 months)

Oil prices are highly likely to stabilise as markets absorb the disruptions, however the elevated security risk surrounding the transit route and infrastructure remains, holding the potential to cause further unexpected changes.

Medium-term (3-12 months)

It is likely that both Kazakhstan and the European Union will push forward policies aimed at securing maritime safety in the region, as well as actively finding viable alternative export routes such as for example the Trans-Caspian Corridor.

Long-term (>1 year)

Outcomes are largely dependent on the evolution of the current conflict, as both sustained escalation or de-escalation will shape the security environment around key infrastructure and transit points, thus impacting Kazakhstan’s oil exports. The upcoming meeting between the United States, Russia, and Ukraine in the United Arab Emirates has the potential to influence the trajectory of the war, however the outcome remains uncertain, leaving risks towards energy transit, infrastructure and exports.