AfCFTA and Africa’s E-Commerce Revolution: Strategic Opportunities, Governance Gaps, and Security Risks in Building a Digital Single Market

By Stephen Nkrumah | 22 January 2026

Summary

The African Continental Free Trade Area (AfCFTA) is speeding up e-commerce growth in Africa by encouraging market integration and supporting digital trade protocols.

Ongoing governance gaps, operational challenges, and increasing cyber threats create serious risks to building a unified digital single market.

Operational and security risks are likely to stay high in the short to medium term unless regulatory harmonisation and stronger infrastructure investment are prioritised.

Context

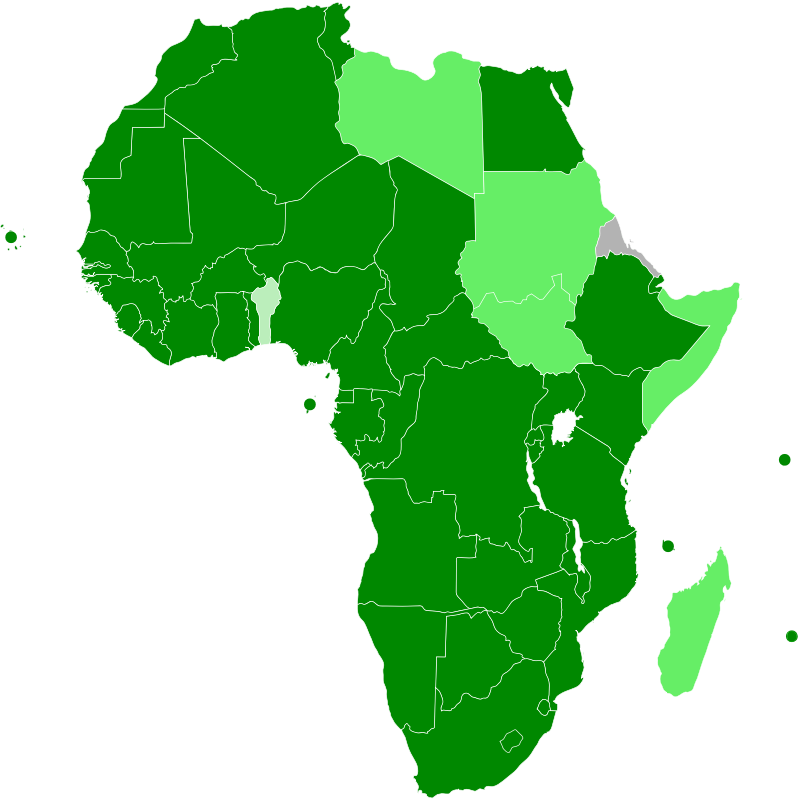

The African Continental Free Trade Area (AfCFTA), launched on 1 January 2021, aims to create the world’s largest single market, covering 55 countries and over 1.3b people. Its digital agenda seeks to reduce barriers to cross-border e-commerce by harmonising rules on customs procedures, digital payments, consumer protection, data governance, and taxation. Key pillars include regulatory convergence, improved digital and logistics infrastructure, payment interoperability, and stronger cybersecurity and data protection frameworks. While Africa’s e-commerce market is projected to reach USD 75b by 2025, limited internet access at just 38% in 2024 continues to constrain inclusive growth.

Although AfCFTA provides a strong framework for digital integration, uneven regulation, weak digital infrastructure, and fragmented cybersecurity systems continue to slow progress toward a true digital single market. The COVID-19 pandemic accelerated online platform adoption, but wide differences in customs rules, payment systems, and consumer protection remain across countries. Platforms such as Flutterwave and Jumia are most widely used in Nigeria, Kenya, and South Africa, where digital payments, internet access, and logistics infrastructure are more developed. This has led to a higher share of e-transactions in these markets, with cross-border e-commerce concentrated along established corridors, while countries with weaker infrastructure continue to rely more on traditional trade channels.

Implications

Operational risks are likely to remain a major constraint on Africa’s e-commerce growth. Weak logistics systems, unreliable address systems, and inconsistent customs procedures continue to raise delivery costs and delays. Gaps in payment interoperability make cash-on-delivery more common, increasing the likelihood of failed transactions and fraud. Reports show that cash on delivery is still a common way people pay for online orders, which is 23% of global transactions in 2025. At the same time, problems with payments, like fraud and failed transactions, remain high, as 33% of consumers surveyed reported experiencing payment fraud, and thousands of parcel scams were recorded in 2025. Fragmented rules on consumer protection, taxation, and product standards raise compliance costs, making rapid expansion into smaller and less-developed markets less likely. As a result, only a few high-capacity corridors are likely to support reliable cross-border logistics, leaving many regions underserved despite growing demand and increasing digital adoption across the continent.

Politically, regulatory uncertainty is likely to persist and shape Africa’s e-commerce trajectory. Slow regulatory convergence and uneven adoption of digital trade and data protection laws across countries create uncertainty for platforms operating regionally. Disputes over digital taxation and cross-border data flows add further risk, increasing the likelihood of delayed investment decisions. Political instability and periodic internet shutdowns, often associated with elections or civil unrest, increase the risk of operational disruptions and can undermine investor confidence. For example, during the 2021 Ugandan general election, internet restrictions were imposed in several regions, disrupting businesses and limiting online financial transactions. Weak enforcement of digital governance also reduces trust, increasing public pressure for restrictive regulations rather than supportive digital trade frameworks.

Economically, AfCFTA-enabled e-commerce is likely to deliver uneven gains. While the framework can expand market access for small and medium-sized enterprises (SMEs), a small number of dominant platforms continue to control logistics and payment systems, creating concentration risks. Currency volatility and inflation weaken consumer purchasing power and make cross-border settlements less predictable. At the same time, uneven investment in digital infrastructure and skills means that benefits are more likely to cluster in countries with stronger logistics and regulatory capacity, potentially widening intra-continental disparities over time.

In terms of security, risks are almost certain to intensify as e-commerce activity expands. Rising transaction volumes increase exposure to cybercrime, including fraud, data breaches, and ransomware, especially given that only more than half of the 54 African countries have a national cybersecurity strategy in 2023. INTERPOL’s 2025 Africa Cyberthreat Assessment Report shows that cybercrime now makes up more than 30 % of all reported crimes in Western and Eastern Africa, underlining how organised criminal groups could exploit weak digital systems. Organised criminal networks are likely to exploit regulatory gaps, enabling scams and illicit trade through digital platforms. Weak consumer protection and limited incident-response capacity amplify losses, while logistics networks face persistent theft and diversion risks, especially for high-value goods in high-crime areas. Inadequate tracking, insurance, and secure delivery systems further undermine trust, reliability, and overall sector resilience across the continent.

African Continental Free Trade Area / Wikimedia Commons

Forecast

Short-term (Now - 3 months)

It is likely that operational constraints and security risks will persist, with cross-border e-commerce activity remaining concentrated in established logistics and payment corridors.

It is also likely that platforms and merchants will continue to face fraud exposure and delivery disruptions due to weak interoperability and uneven enforcement of consumer-protection rules.

Medium-term (3-12 months)

It is likely that regulatory inconsistencies, gaps in data protection, and rising cyber threats will continue to influence e-commerce expansion across AfCFTA markets.

It is likely that firms operating in digitally advanced countries will benefit more from cross-border trade, while smaller markets face slower integration and higher compliance costs.

Long-term (>1 year)

There is a real possibility that, without coordinated governance reforms and sustained infrastructure investment, Africa’s digital single market will remain fragmented.

There is a real possibility that market concentration and systemic cybersecurity risks will rise, potentially limiting inclusive growth and weakening trust in cross-border e-commerce systems.