Greenland and the Infrastructure Foundations of AI competition

By Rakotoarimanga Tinah | 3 February 2026

Summary

Greenland is increasingly framed in policy and industry discussions as a potential enabler of the physical infrastructure supporting AI systems, rather than as a technological hub in its own right.

Its Arctic climate, energy potential, geographic position, and mineral endowment intersect with emerging constraints affecting data centres, advanced computing, and semiconductor supply chains.

The expansion of AI has revealed material constraints, energy availability, cooling capacity, connectivity, and access to critical minerals, which are reshaping how states approach technological dominance.

Context

The rapid scaling of artificial intelligence has exposed a set of material constraints that sit upstream of software innovation. High performance computing depends on advanced chips whose electricity demand and heat density increasingly strain existing power grids and cooling systems. In several regions, these constraints have become binding factors in decisions over where new AI infrastructure can be deployed.

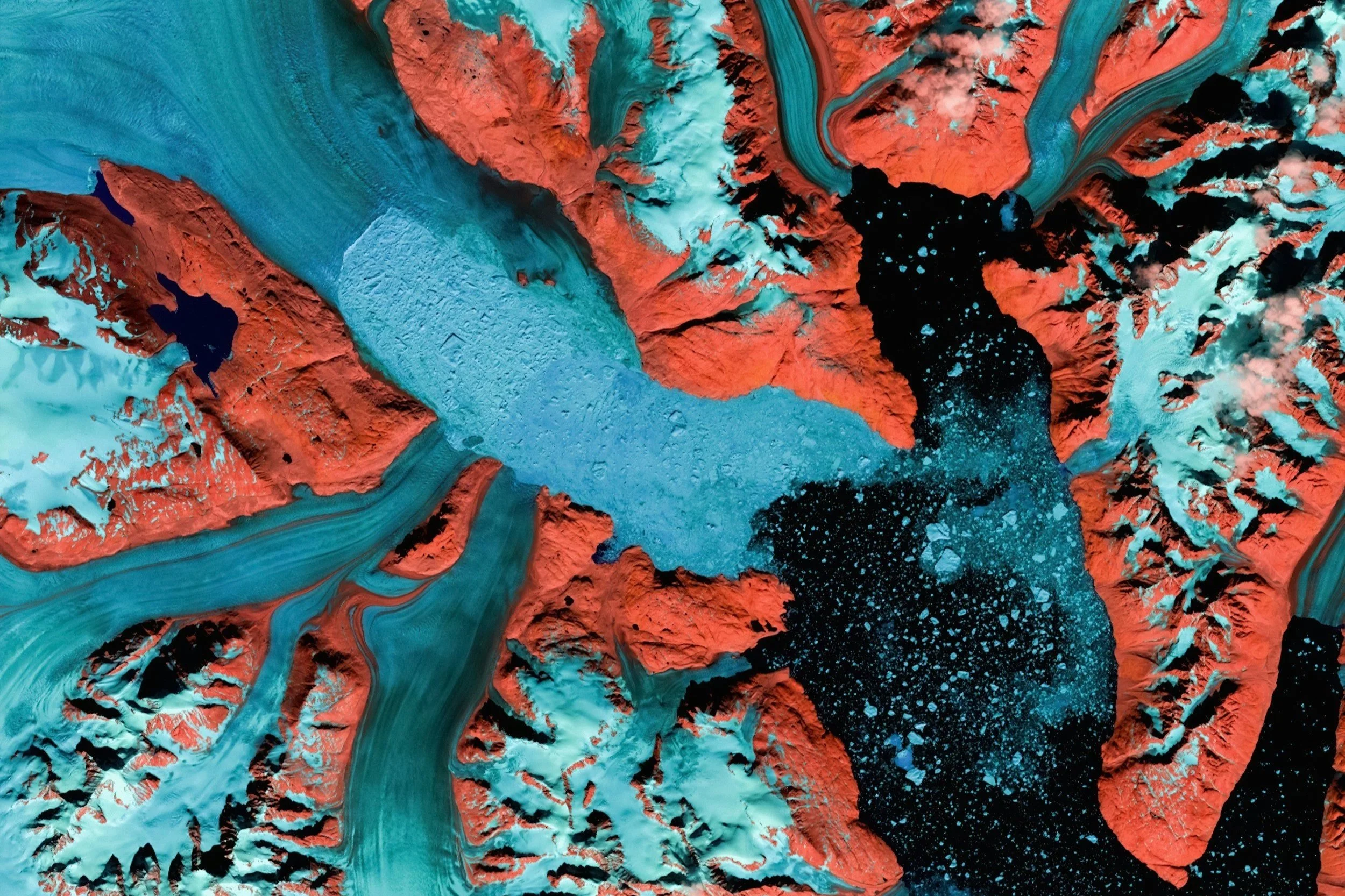

Greenland has entered policy and industry discussions less as a destination for innovation than as a potential response to these constraints. Its sustained low temperatures alter the economics of cooling for compute intensive facilities, while its largely untapped hydroelectric capacity offers a potential source of stable, low carbon power at a time when grid congestion is slowing AI expansion elsewhere. Geography further shapes this assessment. Located between North America and Europe, Greenland features in conversations around transatlantic digital connectivity, particularly as demand grows for resilient, high capacity fibre optic routes capable of supporting data intensive AI workloads.

In parallel, Greenland’s mineral endowment anchors its relevance in debates over semiconductor and hardware supply chains. Deposits of rare earth elements, alongside interest in materials such as germanium and silver, intersect with broader concerns about the concentration of processing and refining capacity,particularly in China. Efforts by the US and its partners to diversify access to critical inputs have therefore brought Greenland into view as one potential component of longer-term risk-management strategies.

Implications

Greenland’s growing prominence reflects a broader shift in the geopolitics of artificial intelligence, in which technological competition is increasingly shaped by material and territorial constraints.

As AI systems become more computationally intensive, strategic advantage is no longer determined solely by advances in chip design, algorithmic efficiency, or model scale; instead, it is progressively influenced by access to land suitable for large scale infrastructure, reliable sources of low carbon energy, cooling capacity, water availability and secure supplies of critical minerals.

Described as a form of “Pax Silica”, capturing efforts to secure technological advantage by stabilising the physical foundations of AI systems rather than focusing exclusively on software or innovation ecosystems.

For the United States and its partners, Greenland is increasingly discussed as a potential asset for supporting broader efforts to manage technological risk and reduce exposure to concentrated supply chains. The island’s relevance lies less in near-term deployment than in strategic optionality, including the ability to diversify locations for energy-intensive infrastructure and to identify alternative sources of critical materials over the longer term. These considerations align with broader U.S.-led initiatives aimed at reshoring, or “friend shoring” segments of the semiconductor and AI value chain, while limiting vulnerabilities associated with reliance on Chinese-dominated processing and refining capacities.

For China, developments surrounding Greenland illustrate the expanding scope of strategic competition into domains traditionally viewed as peripheral to core technology policy. All the restrictions on Chinese investment in Greenlandic infrastructure and mining projects signal a tightening environment for overseas resource acquisition, particularly in politically sensitive regions such as the Arctic. More broadly, these dynamics reflect a change towards increasingly securitised interpretations of infrastructure and resource access, where commercial activities are more frequently filtered through national security and strategic competition frameworks.

Europe and Denmark occupy a more ambivalent position. Greenland features prominently in European discussions on critical raw materials, sustainable mining, and Arctic governance, yet growing US interest in the island exposes underlying tensions between European aspirations for strategic autonomy, transatlantic security dependence, and environmental commitments. From a security perspective, Greenland intersects with NATO concerns regarding the Greenland-Iceland-United Kingdom (GIUK) gap and the gradual opening of Arctic maritime routes. Economically, estimated deposits of rare earth elements, uranium, zinc, and graphite have positioned Greenland within the EU's debates under the Critical Raw Materials Act.

At the local level, Greenlandic authorities face complex trade-offs. External interest in data centres, mining, and infrastructure development presents opportunities to strengthen economic autonomy and reduce long-standing dependence on Danish subsidies. Danish fiscal transfers amount to approximately DKK 4b (USD 580m) annually, representing approximately 20-25% of Greenland’s GDP. Prime Minister Múte Bourup Egede Nielsen has framed industrial expansion, particularly in mining, energy and infrastructure, as central to reducing this long-term dependency.

At the same time, deeper integration into global technology supply chains entails risks of environmental degradation, regulatory capacity constraints, overdependence on external actors, and limited domestic value capture.

Forecast

Short-term (Now - 3 months)

Greenland is unlikely to become a major standalone hub for AI infrastructure.

Its role remains likely limited to exploratory discussions, feasibility assessments and strategic signalling by external actors.

Protests will likely increase in Greenland to claim independence from Denmark and against US threats on the territory.

As a result, there is a possibility that immediate economic and security impacts are expected, with limited implications beyond agenda setting.

Medium-term (3-12 months)

Interest in Greenland as a supporting component of AI-related infrastructure is likely to persist; this will affect strategic planning around energy provision, connectivity resilience and critical mineral diversification rather than leading to concrete deployment.

The impact is assessed as low to medium, shaping supply chain risk assessments without significantly altering the operational landscape.

Highly likely increased tensions since the US has intensified calls for control over Greenland, which can create potential pressure on NATO.

Long-term (>1 year)

Greenland is likely to reflect a broader shift in AI competition towards control of material and territorial foundations. While Greenland itself may remain a secondary node.

Greenland is unlikely use the US interest to speed up independence from Denmark.

Similar Arctic and sub-Arctic territories are very likely to gain strategic relevance, increasing the securitisation of infrastructure but also energy and resource access, with wider implications for geopolitical competition and Arctic governance.