Fintech Expansion in West Africa: How Mobile Money Is Reshaping Banking and Trade

By Stephen Nkrumah | 2 December 2025

Summary

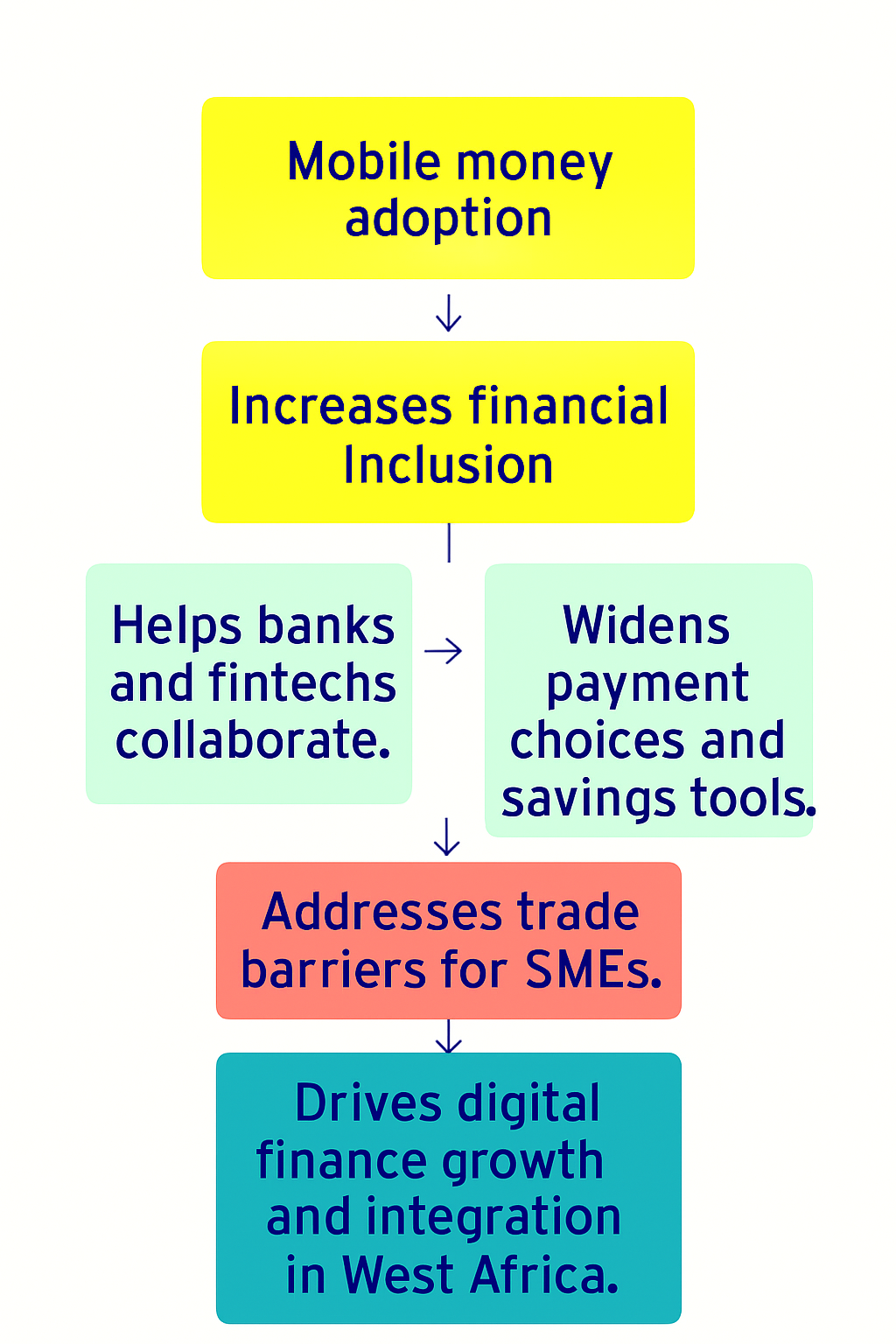

Digital finance adoption has grown rapidly across West Africa, offering affordable payments, savings, credit, and insurance to users and businesses that were previously left out.

Banks and fintechs are now working together to provide services that reduce cash use and ease trade challenges for SMEs, while regulators continue to improve interoperability and strengthen consumer protection.

Over the next 1–3 years, wider digital ID systems and stronger digital payment systems are expected to increase usage and support cross-border trade, even though cyber risk and infrastructure gaps remain important concerns.

Context

West Africa is experiencing rapid growth in digital finance, mainly driven by mobile money platforms that make everyday transactions easier and help more people access formal financial services. The region reached about 356m registered mobile money accounts by the end of 2023, with Ghana and Nigeria leading in both adoption and transaction values. Services like MTN Mobile Money, M-Pesa and Orange Money now support transfers, bill payments, merchant payments, savings, small loans and insurance, and they are increasingly used for cross-border payments.

Financial inclusion, which means providing affordable services that meet people’s needs responsibly, helps reduce poverty, supports women’s empowerment, and strengthens resilience; thus, mobile money has played a major role in expanding access across Sub-Saharan Africa.

Implications

Political dynamics are very likely to remain the most significant threat to national financial inclusion strategies. Fragmented regulations, slow law-making, and weak enforcement create uncertainty, which becomes worse during election periods. Leadership changes and cabinet reshuffles often delay digital ID expansion, payment-system reforms, and cross-border interoperability. The issue is not just “political instability” but the fact that financial inclusion needs a steady and predictable policy process. So political volatility disrupts this process at the exact time when reforms are gaining momentum. It is a realistic possibility that rising polarisation and misinformation will reduce public trust and push vulnerable groups back to cash-based systems. Hence, political risk remains the most serious structural challenge.

In terms of operation, it is likely that the growth of real-time payments, national IDs, and cross-border standards will help reduce SME transaction costs and improve efficiency. Still, there is a real possibility that gaps in last-mile connectivity, rural infrastructure, and digital literacy will slow adoption more than expected. This suggests that progress will be uneven; urban and well-connected areas may see fast uptake, while remote communities remain left behind. The result is that financial inclusion could widen inequalities before it reduces them: people who are already well-served get faster access, while those at the margins still struggle with basic connectivity.

In terms of security, it is almost certain that security risks will increase as transaction volumes grow. Fraud, identity theft, and cyberattacks are not side issues; they directly threaten user confidence and the stability of digital finance systems. A few high-profile breaches could easily slow the digital inclusion agenda, especially if trust among SMEs and consumers drops. Weak dispute-resolution systems and poor consumer protection make this even worse, pushing people back to cash. Therefore, security risk is the most immediate operational threat, even though political risk remains the biggest structural one.

Economically, it is likely that digital payments will help boost SME productivity, reduce transaction costs, and strengthen credit histories, which can support medium-term economic growth. But there is also a real possibility that macroeconomic pressures like inflation, debt stress, and currency volatility will limit how much governments and firms can invest in the digital infrastructure needed for wider inclusion. This means the economic gains may be partial and fragile, with progress easily disrupted by external shocks like changes in commodity prices or interest rates that reduce fiscal space and slow investment.

Fiona Graham/Wikimedia

Forecast

Short-term (Now - 3 months)

It is likely that interoperability upgrades and consumer-protection measures will reduce fraud exposure and improve dispute-resolution efficiency.

It is also likely that retail users and SMEs will benefit from faster settlement, higher merchant acceptance, and safer participation in digital payment ecosystems.

Medium-term (3-12 months)

It is likely that the expansion of digital ID systems and risk-based regulation will widen MSME access to credit and micro-insurance.

It is likely that MSMEs and cross-border traders along the Ghana–Côte d’Ivoire–Nigeria corridors will benefit from AfCFTA-aligned payment pilots that lower transaction costs and help scale regional trade.

Long-term (>1 year)

There is a real possibility that regional payment harmonisation and stronger credit infrastructure will help narrow the MSME finance gap, which can increase formal trade and boost productivity.

There is a real possibility that cybersecurity standards will improve, but steady investment will still be needed to manage systemic risks and protect financial stability.