Economic and Security Costs of Political Instability: The case of France

By Francesco P | 16 December 2025

Summary

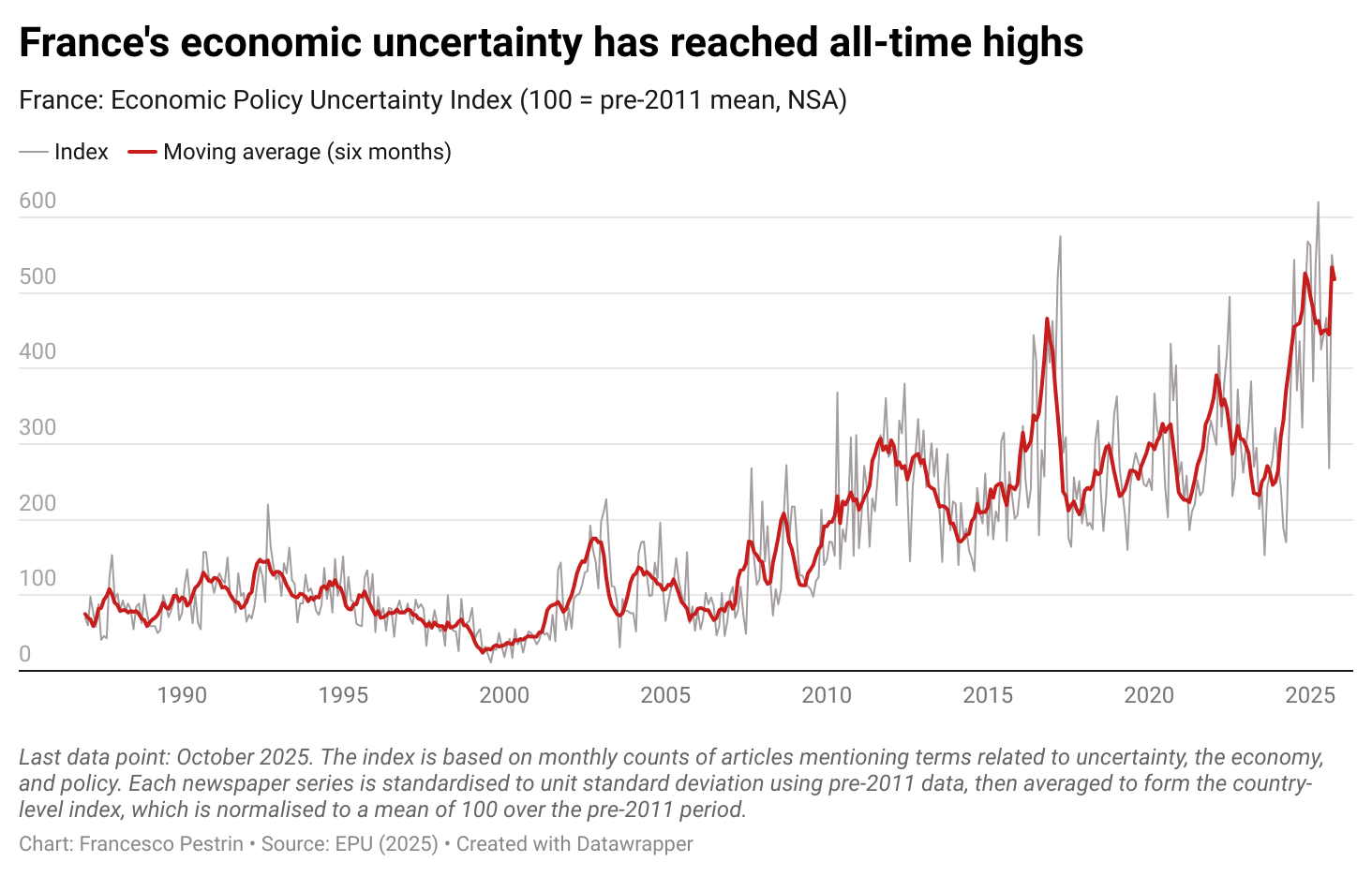

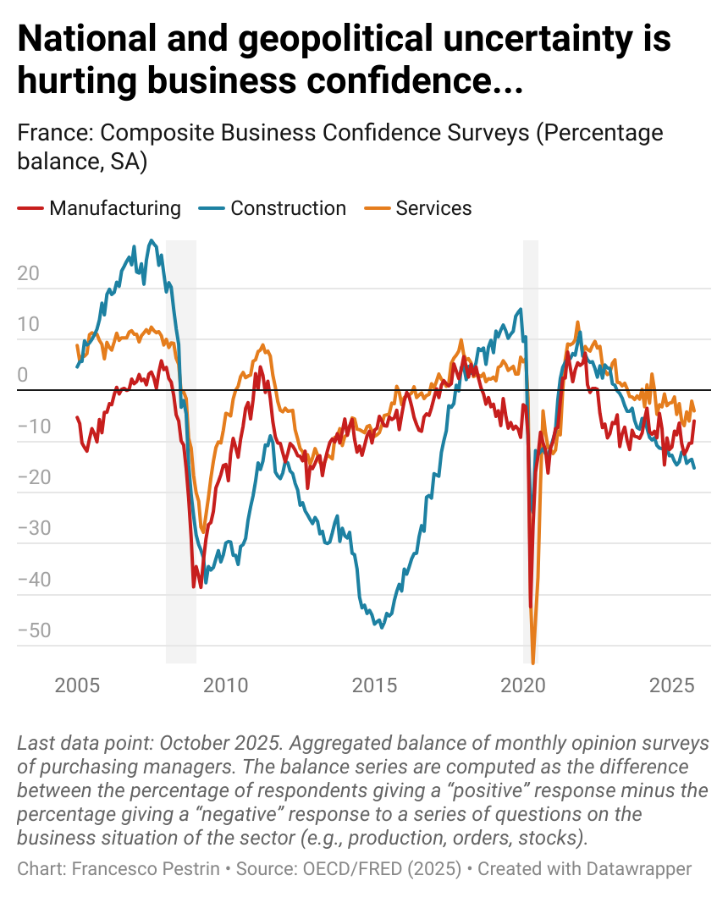

Political turmoil in France since mid-2024 has led to heightened economic uncertainty, undermining business and consumer confidence, delaying investments, and increasing borrowing costs.

The elevated yields driven by political risk are raising the fiscal cost of France’s planned defence spending increase under the 2024–2030 Military Planning Law, limiting political will to stay the new military policy course.

Persistent uncertainty highlights the need for a structurally coordinated European defence financing framework in the medium term to share fiscal burdens and reduce political tensions. Such coordination should ensure transparent governance and clear reimbursement rules to support sustainable and credible defence investments across member states.

Economic uncertainty fueled by political turmoil

France has faced a deep political crisis since June 2024, when President Emmanuel Macron called a snap election after his camp’s defeat in the European elections. The vote saw the far-right National Rally (RN) party emerge as the leading force (+37 MPs since the previous election), while the left-wing alliance New Popular Front (NFP) consolidated its position (+17 MPs), leaving Macron’s centrist bloc without a working majority. In just over a year, three prime ministers have resigned, and the current government struggles to agree on budget measures to reduce France’s 2024 deficit of 5.8% of GDP.

Political turmoil has pushed French economic uncertainty to record highs. Business confidence on future activity, employment, and order books remains fragile (a 6% decline in confidence among manufacturing managers in October 2025), prompting delays on investment decisions. Consumer confidence stays depressed, with the unemployment rate (7.7% of the labour force in Q3 2025) weighing on household sentiment. Strong public spending and rising net exports provide some support, but the Banque de France estimates that uncertainty has already trimmed 2025 growth by around 0.2 percentage points.

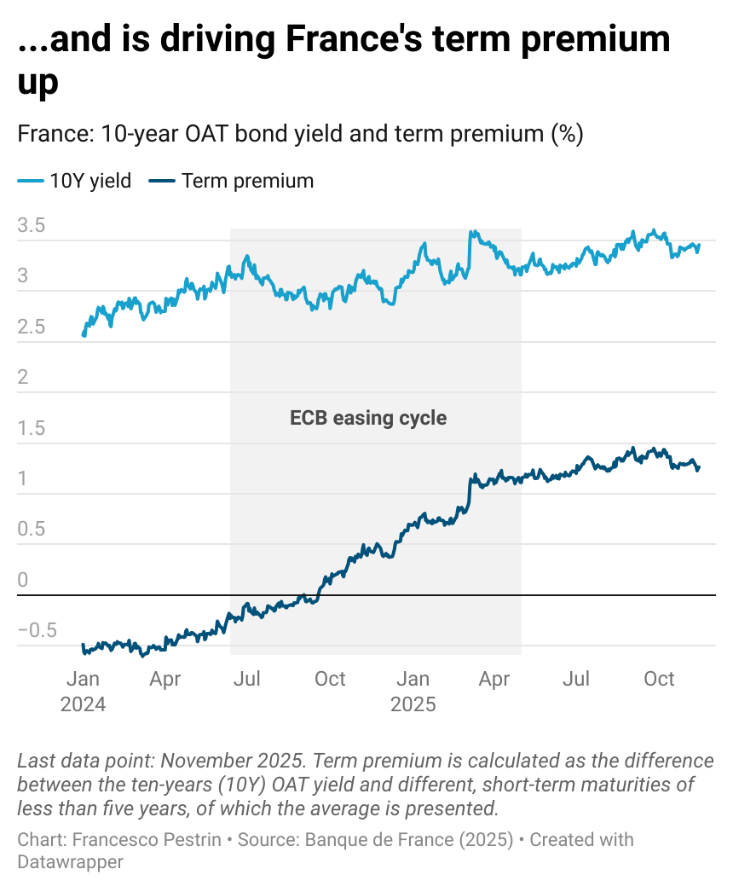

Markets are pricing in current political risk. By end-October 2025, the spread between ten-year French and Italian government bond yields—the latter traditionally seen as a benchmark for riskier eurozone sovereigns—has not only reached but has even exceeded parity. Term premium, i.e., the difference between long-term and short-term government bond yields, remains elevated, even after the European Central Bank (ECB) ended its policy rate easing phase. This indicates that investors are factoring in long-term issues, notably France’s ability to tame its debt burden (116% of debt-to-GDP ratio at Q2 2025), beyond more immediate concerns on political fragmentation.

Implications of uncertainty on defence debt management

Higher yields mean costlier debt issuance going forward, with implications for national security.

The French Military Planning Law (PLM) 2024–2030 targets EUR 80 bn (USD 92 bn) in military expenditures by 2030 (current prices), representing a 36% increase compared to the 2024 level. Assuming this increase is financed purely through government borrowing, the expected cost of servicing this additional debt can be estimated under different scenarios. Relative to a benchmark scenario where yields at different maturities revert to pre-2024 levels (before the spike in political uncertainty), the ‘current environment’ scenario—reflecting today’s elevated yields persisting through 2030—would amplify the fiscal burden by approximately +9.6%, raising projected costs from around EUR 62 bn (USD 71) to EUR 68 bn (USD 78) at the 2030 horizon alone. The most severe scenario, which assumes French yields at the peak of the 2007-09 Great Financial Crisis (GFC), would add +5.6 percentage points to the ‘uncertainty’ scenario, pushing costs to about EUR 72 bn (USD 83 bn) by 2030.

Uncertainty is amplifying the fiscal burden of France’s defence build-up. Rising debt servicing costs are reducing the likelihood of meeting PLM objectives and increasing the political cost of sustaining the new defence spending policy. Uncertainty could, however, intensify further if France delays or limits action to fulfil its external defence commitments, namely, its 3.5% of GDP NATO pledge, thereby weakening its deterrent posture vis-à-vis the Russian Federation and making the defence’s ramp-up even more costly in the medium term.

This national challenge reflects a broader European dilemma: fragmented defence spending and rising fiscal pressures hinder the continent’s ability to build strategic autonomy. The recent proposal for a European Future of Defence Architecture addresses these issues by advocating for a coalition of willing EU countries to pool resources, coordinate long-term procurement, and jointly finance next-generation defence technologies. By establishing robust governance structures and issuing joint Future of Defence Bonds, Europe can overcome individual fiscal constraints and strengthen its collective deterrent posture, providing a better regulatory visibility to corporates, thereby mitigating individual countries’ uncertainty, as currently faced by France.

Rebecca Hausner/Unsplash

Forecast

Short-term (Now - 3 months)

France is expected to finalise its 2026 state budget, following the approval of the social security budget, potentially replicating the experience of the “loi spéciale” of January 2025, by which a temporary measure authorised the collection of taxes and public resources to finance essential public expenditures, reducing uncertainty…

…but necessary political compromises will likely postpone significant measures to correct the debt trajectory until after President Macron’s term, maintaining high uncertainty.

Medium to long-term (>3 months)

Highly likely that French institutions will prepare the population to accept a sustained increase in military spending, not least through the reintroduction of European conscription models (volunteering schemes), thus reducing the political cost of defence spending’s ramp-up.

Realistic possibility that France, as well as other European countries, will call for joint debt issuance at the EU-level, as in the case of the 2020 NextGenerationEU (NGEU), to reduce the burden on national finances, leveraging relatively lower yields, conditional on clear reimbursement rules.