All-In on Bitcoin: Is Michael Saylor’s Strategy about to Unwind?

By Tom Everill | 16 December 2025

Summary

Michael Saylor and Strategy Inc. have pioneered the corporate Bitcoin treasury model, holding 650,000 BTC (~3% of total supply) and offering Bitcoin-linked financial products.

Digital Asset Treasury companies are growing rapidly, using crypto holdings and ‘financial engineering’ to generate returns above assets’ market value, but face concentration, leverage, and regulatory risks.

Context

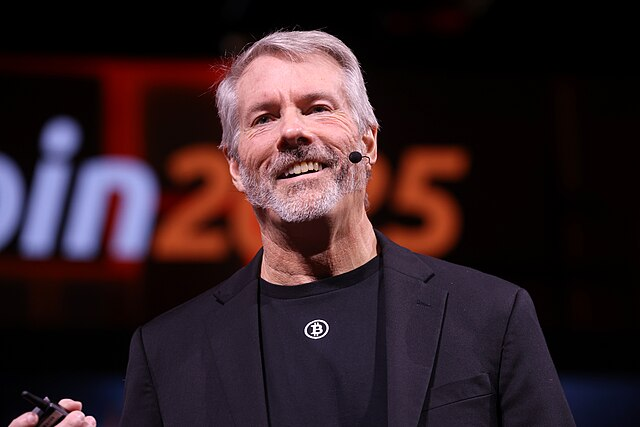

Michael Saylor, CEO of Strategy Inc. (formerly MicroStrategy), is best known for his relentless public proselytising on Bitcoin (BTC), which he regards as the ultimate store of value and “hard money.” Saylor is a controversial figure - not only in business, given that he has staked much of his company’s fortunes on the price of the world’s largest cryptocurrency, but also within the digital asset community. There, while some view him as a champion of the cause, others argue that his Bitcoin stockpile undermines the technology’s original promise of a decentralised, permissionless financial system.

Strategy Inc. (formerly MicroStrategy)

Since its first Bitcoin purchase in August 2020 (21,454 BTC for USD 250m), Strategy has pioneered a new way for corporations to interact with and benefit from crypto - morphing from a traditional software firm into the first Bitcoin treasury company. Strategy is now the world’s largest corporate Bitcoin holder, having accumulated 650,000+ BTC at various price points (yellow dots in the below chart). These holdings, worth approximately USD 60b as of December 2025, constitute roughly 3% of Bitcoin’s maximum supply.

As it built this position, Strategy began restructuring its product suite almost entirely around Bitcoin exposure. Its common stock ($MSTR) is branded ‘Amplified Bitcoin’ due to an expectation that it will function as a high-beta proxy for Bitcoin, meaning its price action is correlated with, but more volatile than, the cryptocurrency’s itself. In the two weeks following the 2024 United States (US) Presidential election, this expectation was validated with $MSTR’s price increasing by over 100% between the election (5 Nov.) and its peak on 20 November as the price of BTC increased by only 33% over the same period.

Strategy also offers several Bitcoin-backed credit instruments with attractive fixed-income yields relative to traditional corporate or government debt. Most notable is its convertible bond ($STRK) which, unlike standard bonds, can be converted into equity, allowing holders to participate in equity upside. These instruments are issued by Strategy in opportune moments to fund its BTC purchases.

Some have playfully dubbed Strategy’s business model, an “infinite money glitch,” due to its in-built reflexive mechanisms. (1) Saylor is able to raise money at zero or near-zero rates (see risks section ahead) (2) which he uses to buy Bitcoin; (3) both material demand from Strategy and a public expectation of continued purchases drives Bitcoin’s price up. (4) This, in turn boosts Strategy’s share price, allowing it to attract more investment, accumulate more Bitcoin and pay its creditors (and the cycle restarts).

Digital Asset Treasury Companies

Between 2021 and 2025, the number of publicly-traded US companies holding BTC on their balance sheets increased from fewer than 10 to 190, with others implementing similar strategies using different cryptocurrencies like Ether and Solana. These companies have become known as Digital Asset Treasuries (DATs) and seek, like Strategy, to provide returns exceeding what would be achieved by simply holding the underlying digital asset.

DATs have attracted investment, in part, by offering exposure to crypto-assets through the equity or debt of publicly-traded companies, appealing to investors who are uncomfortable with crypto self-custody. In this sense, DATs can be understood as an alternative to Bitcoin exchange-traded-funds (ETFs), like Blackrock’s $IBIT, where investors seek exposure to the underlying asset, but via regulated financial products.

The performance of these companies is commonly evaluated using a Modified Net Asset Value (mNAV) ratio, which compares a company’s equity market capitalisation to the market value of its (digital) assets. A ratio greater than 1 indicates that the stock trades at a premium to its underlying assets, reflecting investor confidence, while a ratio below 1 signals a discount, suggesting scepticism or perceived risk.

Key Risks

Institutional Investment Motivations

While Strategy has drawn significant institutional investment in recent years, propelling its BTC accumulation, it does not necessarily reflect an endorsement of the company, leader or business model. Much of this investment comes in the pursuit of arbitrage opportunities, with institutions using volatility-induced mispricing between the convertible bond and common stock ($MSTR) to generate trading profits.

As a result, institutions are willing to buy Strategy bonds with little or no interest - providing the company with interest-free loans. In a May 2025 FT documentary, Saylor notes: “we borrowed about 10b in convertible bonds at about 1%” and “5b in the last few months at 0%”. This cheap borrowing underlies Strategy’s business model, raising concerns over dependence on arbitrageurs and scalp traders, as well as the sustainability of the model independent of them.

Market, Concentration & Dilution

Furthermore, DAT companies naturally carry major concentration risk because their balance sheets are dominated by a single highly-volatile asset or a number of highly volatile, highly-correlated assets. As crypto prices fall, equity values follow, liquidity tightens, and the ability to refinance debt and pay dividends is diminished. This produces a parallel, reflexive cycle downwards in which lower digital asset prices directly impair operational flexibility.

In November 2025, these risks became increasingly salient as heavy Bitcoin losses caused Strategy’s mNAV ratio to briefly fall below 1 for the first time, while $MSTR’s share price plummeted - having shed roughly 62% of value from its July 2025 high by December. The severity of the pullback, triggered by a Bitcoin sell-off of only minus 28%, led to concerns among some analysts over Strategy’s resilience in the face of more extreme downside volatility. In response, Saylor declared his company capable of surviving, “an 80% to 90% drawdown” in Bitcoin “and keep on ticking,” while describing its leverage as “extremely robust”.

On 1 December, Strategy announced the establishment of a USD 1.44b cash reserve to support dividend and interest payments, a move Saylor described as, “the next step in [Strategy’s] evolution,” better positioning the company “to navigate short-term market volatility.” Critics, however, are less generous: prominent angel investor Jason Calacanis, for example, branded recent developments a “massive red flag” and demonstrative of the unsustainability of a model dependent on perpetual Bitcoin appreciation.

Shareholder Dilution

Shareholder dilution is another core risk for firms like Strategy that rely heavily on convertible debt and equity-linked financing to fund ongoing digital asset accumulation. It creates a persistent overhang of potential share issuance, particularly during periods of equity weakness, where more shares must be issued to raise the same amount of capital.

Regulatory & Contagion Risks

Because DATs’ identities and operations are inexorably linked to crypto-assets, they are highly exposed to shifts in taxation, securities rules, accounting standards, or crypto-specific regulations. Although the current Trump administration is widely regarded as the most crypto-friendly in history, future administrations may choose to implement more restrictive frameworks.

Forecast

Short-term (Now - 3 months)

Strategy will likely fall back on its USD 1.44 b reserve to maintain dividends and stabilise investor confidence amid Bitcoin volatility.

Medium-term (3-12 months)

Partial stock recovery likely if Bitcoin stabilises; DATs may refine risk management and consider diversification to reduce concentration risk.

Long-term (>1 year)

Strategy could, with a realistic possibility, cement its role as a leading corporate Bitcoin holder with strong financial products, but regulatory changes and market volatility remain key risks.