US Arrest of South Korean Workers Troubles Trump’s Foreign Investment Push

By David Yang | September 2025

Summary

United States (US) Homeland Security authorities arrested 475 workers at the construction site of a joint Hyundai and LG Energy Solutions electric vehicle (EV) battery factory in Bryan County, Georgia.

The workers, mostly South Korean nationals, were detained for allegedly engaging in paid employment that their short-term visas prohibited. South Korean firms blame unduly long work visa approvals, and that restrictive immigration law is contrary to the US’ desire for rapid rollout of large investment projects.

The move complicates South Korea’s proposed USD 350b of private investment into the US as part of trade negotiations to reduce tariffs. US President Donald Trump is highly unlikely to make obtaining work visas any easier for foreign firms, which will likely delay projects and cause many firms to reassess investing in the US.

The arrests of 475 workers in a raid by the US Department of Homeland Security on an EV battery factory have shocked foreign firms, as President Trump’s stringent immigration policy clashes with his push for greater foreign investment into the US. 300 of those detained at the site, a USD 4.3b joint EV battery plant between Hyundai and LG Energy Solutions, were South Korean nationals who have been accused of illegally working on short-term visas that prohibit paid employment in the US. The South Korean government has arranged for the 300 nationals to be flown back on a chartered flight.

Many multinational firms, even outside of South Korea, have suspended some business travel to the US over uncertainty of their exposure to falling foul of immigration law, a trend that has already started among European businesses. Paid work is most commonly allowed under the H1-B visa, but only 85,000 are distributed every year by a lottery amongst applicants. South Koreans only receive around 2,000 per year. To supplement the needs of skilled factory, construction, and engineering workers to contribute to and advise projects in the US on short notice, South Korean firms have long resorted to using short-term visas not intended for paid employment as workarounds.

This is not a new problem. Federal and state governments have often turned a blind eye to workers skirting immigration rules, especially in order to quickly complete pledged infrastructure projects as part of former President Joe Biden's push for 'reshoring', which attracted USD 263b up to March 2024.

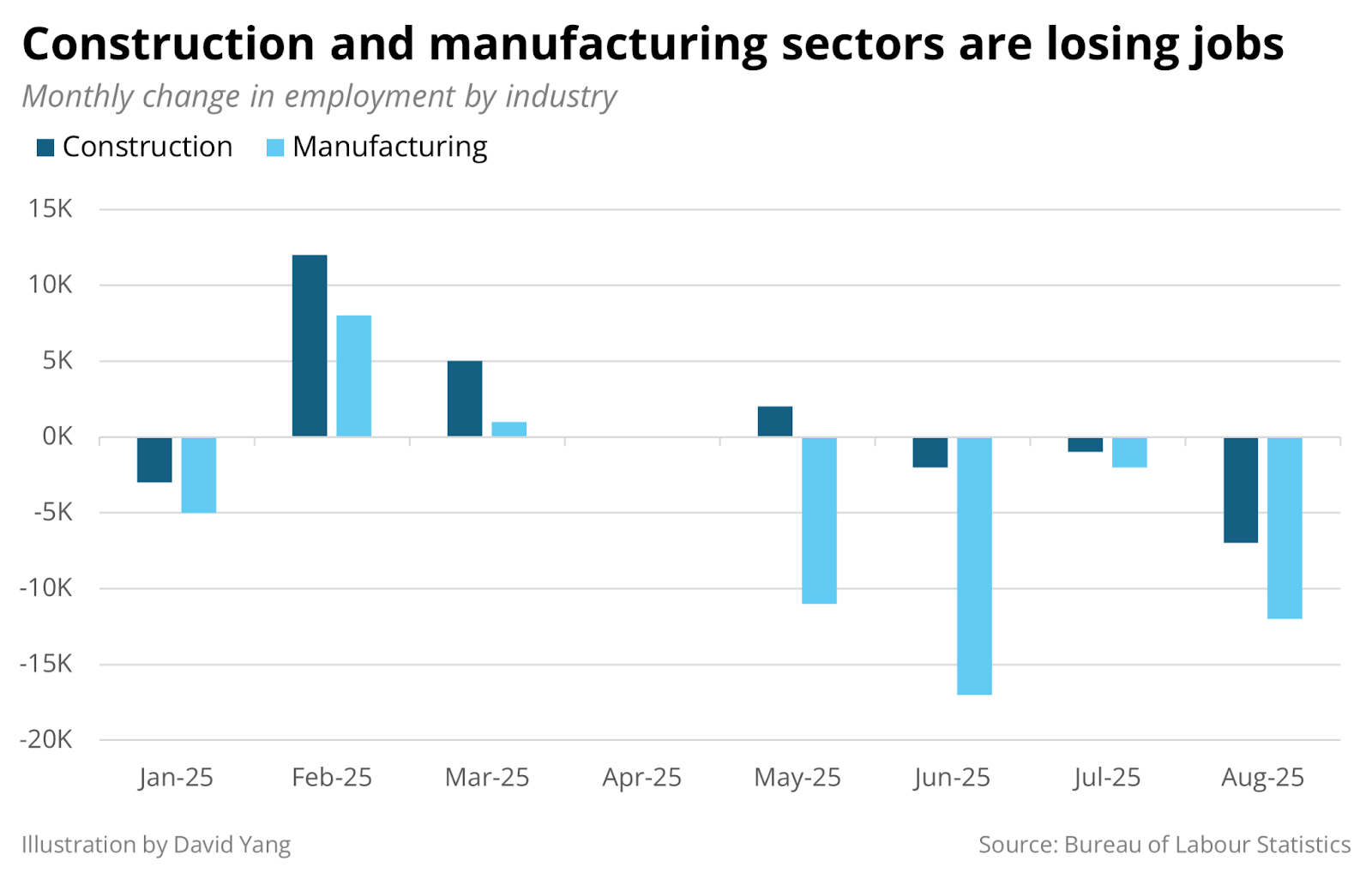

President Trump is keen to continue the resurgence in American manufacturing, extracting pledges of FDI within the sector as part of deals the US strikes to reduce tariffs on trade partners, including USD 550b from Japan, USD 600b from the European Union, and a proposed USD 350b from South Korea. Yet his stringent immigration policy is hindering foreign firms’ ability to fulfil their investment pledges. On top of the need for skilled experts, companies are struggling to hire labourers in construction and manufacturing to build and operate their plants. The construction sector is forecasted to require a net increase of 439,000 workers in 2025 to keep up with demand, yet year to date, construction employment has only risen by 9,000. The US’ construction and manufacturing sectors rank first and third in employment of undocumented workers, indicating that Trump’s deportations are likely to blame for the recent decline in their labour supply. Facing squeezes on both skilled experts and trained labour, the need to ensure strict visa compliance will induce project delays and deter future investment.

However, the Trump administration is very unlikely to cater to foreign firms’ requests. The government is doubling down on its immigration policy, launching a review of all 55m visa holders for rule violations and proposing even stricter requirements on obtaining H1-B work visas. Immigration remains a higher priority to core Republican voters than attracting inward investment, making any relaxation of immigration rules highly unlikely as the 2026 midterms approach. By tightening immigration enforcement, firms may reassess the feasibility of US projects, with South Korea warning that its businesses will hesitate to invest without a better visa system. Trump threatens not just automotive and electrical manufacturing projects, but also security priorities, such as South Korea’s USD 150 billion investment in US naval shipbuilding capabilities.

Forecast

Short-term (Now - 3 months)

The raid will likely sour relations between the US and South Korea and complicate ongoing trade deal negotiations, already complicated by disagreements over exchange rate policy.

There is a realistic possibility that the finished deal may be delayed by several more months, but it is likely that one will be announced by the end of 2025 due to South Korea’s vulnerability to tariffs.

Medium-term (3-12 months)

Current FDI projects in the US will likely face delays well into mid-2026 as firms seek to strictly comply with US immigration law.

Further raids on FDI sites are a realistic possibility, with other companies likely repatriating workers that might be targeted by immigration enforcement.

Long-term (>1 year)

New FDI flows into the US will likely slow, as foreign firms beyond South Korea assess higher risks and costs investing in the US.

Immigration policy is likely to become stricter as both the administration and congressional Republicans appeal to their core voter base ahead of the 2026 midterms.