Turkey’s Drone Industry

By Victoria Sainz | 26 January 2026

Summary

Turkey’s rapid rise as a drone power stems from state backed domestic production following past sanctions, with Baykar’s Bayraktar TB2 driving global market leadership, export growth, and technological autonomy

The drone industry underpins a more assertive foreign policy and domestic ideological narrative, strengthening Erdogan’s authority, regional battlefields, and long-term dependencies for client states.

Turkey is expected to sustain drone exports and geopolitical influence in the near to medium term, with longer term growth dependent on managing regulatory pressure and competition.

Context

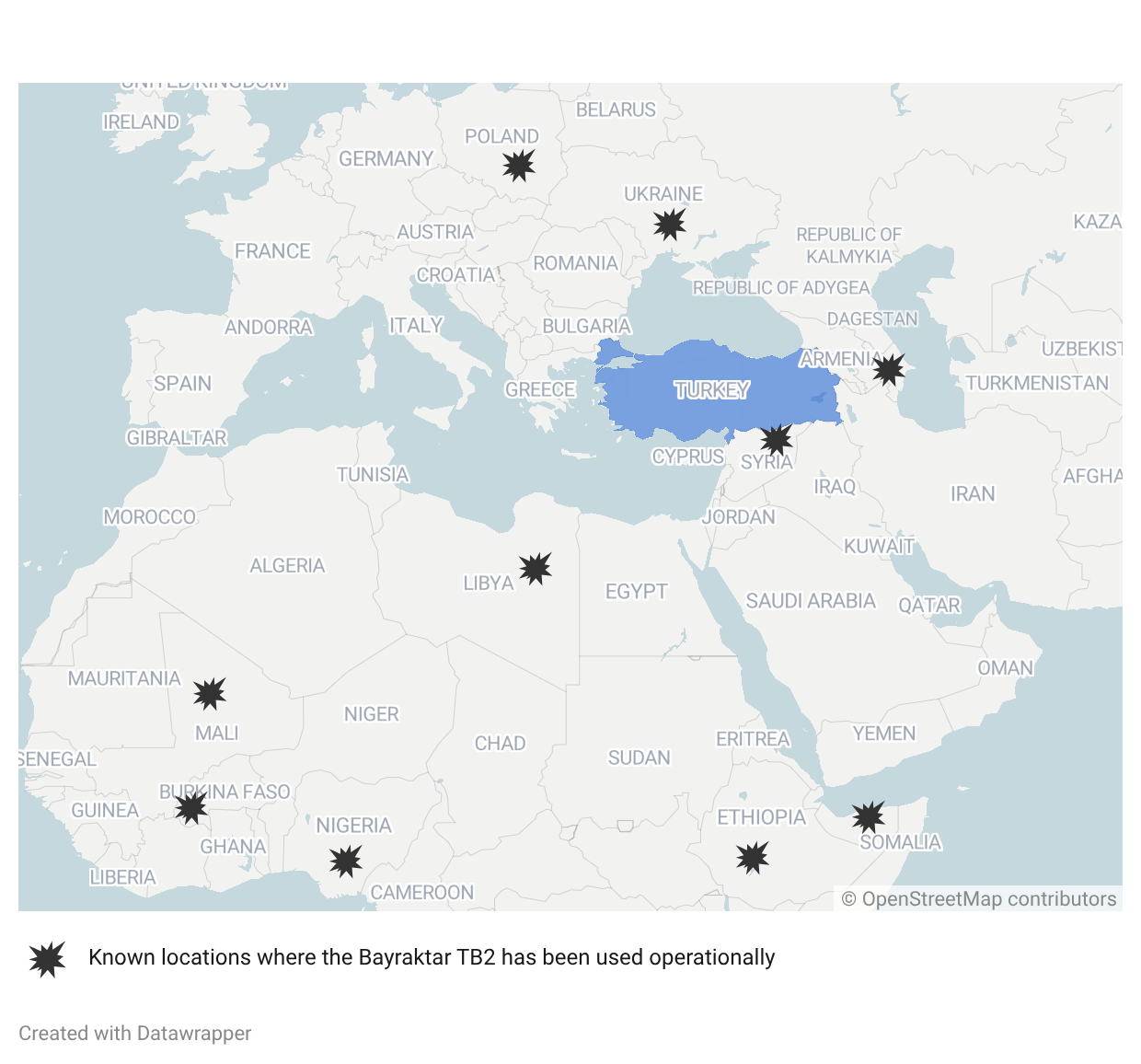

Turkey has seen an important surge in its drone industry in recent years and has managed to put itself as the global leader in drone technology, controlling over 65% of the drone market. This rise is characterised by the success of one of its many companies, Baykar, and its flagship Bayraktar TB2, which has proven effective in battlefields such as Ukraine, Syria and Libya. This growth is rooted in a deliberate shift from reliance on foreign defence technologies to assertive local production, due to state investment and historical experiences with foreign arms embargoes and sanctions.

These international sanctions follow the country’s 2019 invasion of northern Syria and are aimed at challenging Turkey’s foreign policy in the Middle East. The drone boom is therefore a source of intense national pride and technological independence, providing substantial export revenue (reaching USD 7.1 b in 2024) and boosting the Turkish economy. For instance, in 2025, 80% of the resources required for production were provided by Turkish companies.

Implications

The success of the drone industry enables a new form of assertive, technologically driven interventionalism, aligning with President Erdogan’s ambitious Islamist and neo-Ottoman vision. Domestically, this achievement is utilised as ideological propaganda, framed as the victory of “Muslim-rooted” science and a “national technological leap”, which reinforces national pride and presidential authority. Externally, the export of military technology, known as “drone diplomacy”, is employed to forge new geopolitical alliances and deepen Turkey’s influence, particularly with Islamist-aligned forces like Qatar and movements such as Hamas. This policy frequently strains relationships with NATO allies.

On the battlefield, Turkish Unmanned Aerial Systems (UAS), notably the Bayraktar TB2, have become decisive force multipliers in several regional conflicts. Their relatively low cost, easy deployment, and proven effectiveness have allowed client states to rapidly enhance their military capabilities. Turkish exporters gain leverage over clients by supplying necessary components like guided micro-rockets, spare parts, and frequent software upgrades, creating lasting dependencies on Turkey.

At a global level, the proliferation of Turkish drones contributes to a broader global trend towards remote warfare, which may promote conflict escalation and instability. Turkey’s permissive export controls, compared to those of the US and Europe, increase the concerns that drones could fall into the hands of non-state actors or be used in ways that may worsen existing tensions. In urban counter-terrorism and urban warfare contexts, the use of armed drones can increase the danger of civilian casualties, as seen in reports from Nigeria and Ethiopia. This diffusion of military technology also transforms regions like Africa into new competitive battlegrounds for drone exporters such as the US, which is likely to respond by tightening export controls, boosting its own drone companies to clients and threatening diplomatic sanctions to limit Turkey’s role in drone supply abroad.

The drone surge represents a successful transition from foreign dependency to active domestic defence manufacturing. The Turkish economy has seen substantial export revenue with goals to hit USD 10b by the end of 2025. This commercial success is largely driven by competitive price/ performance ratios of the drones, such as the TB2 model costing approximately USD 5m per unit, making them significantly more affordable than rivals like the US MQ-9 Reaper (estimated at USD 20m).

Forecast

Short-term (Now - 3 months)

Turkey likely continues strong drone exports, particularly to Africa and the Middle East, with sustained deliveries and active drone diplomacy. Indeed, supply chains are unlikely to face disruption, as most components are now domestically sourced, insulating production from external pressure.

Medium-term (3-12 months)

It is highly likely that Turkey will expand production capacity and secure new export contracts, despite growing political criticism from Western partners. Ankara is expected to leverage drone exports to secure basing rights, security cooperation agreements, and diplomatic alignment, particularly in Africa and the Gulf. Additionally, frictions with NATO are likely to continue, but are unlikely to produce any additional trade restrictions.

Long-term (>1 year)

There is a realistic possibility that Turkey will retain a strong global position in drone exports, although growth may be moderated by tighter regulation, competition, and market saturation. While Turkey is likely to remain a major exporter, market saturation in key regions and the entry of competitors such as China could limit further expansion. Continued success depends on Ankara’s ability to innovate and move higher on autonomous systems without trigger greater international backlash.