The EU-India Trade Deal

By Kira Persson | 19 February 2026

Summary

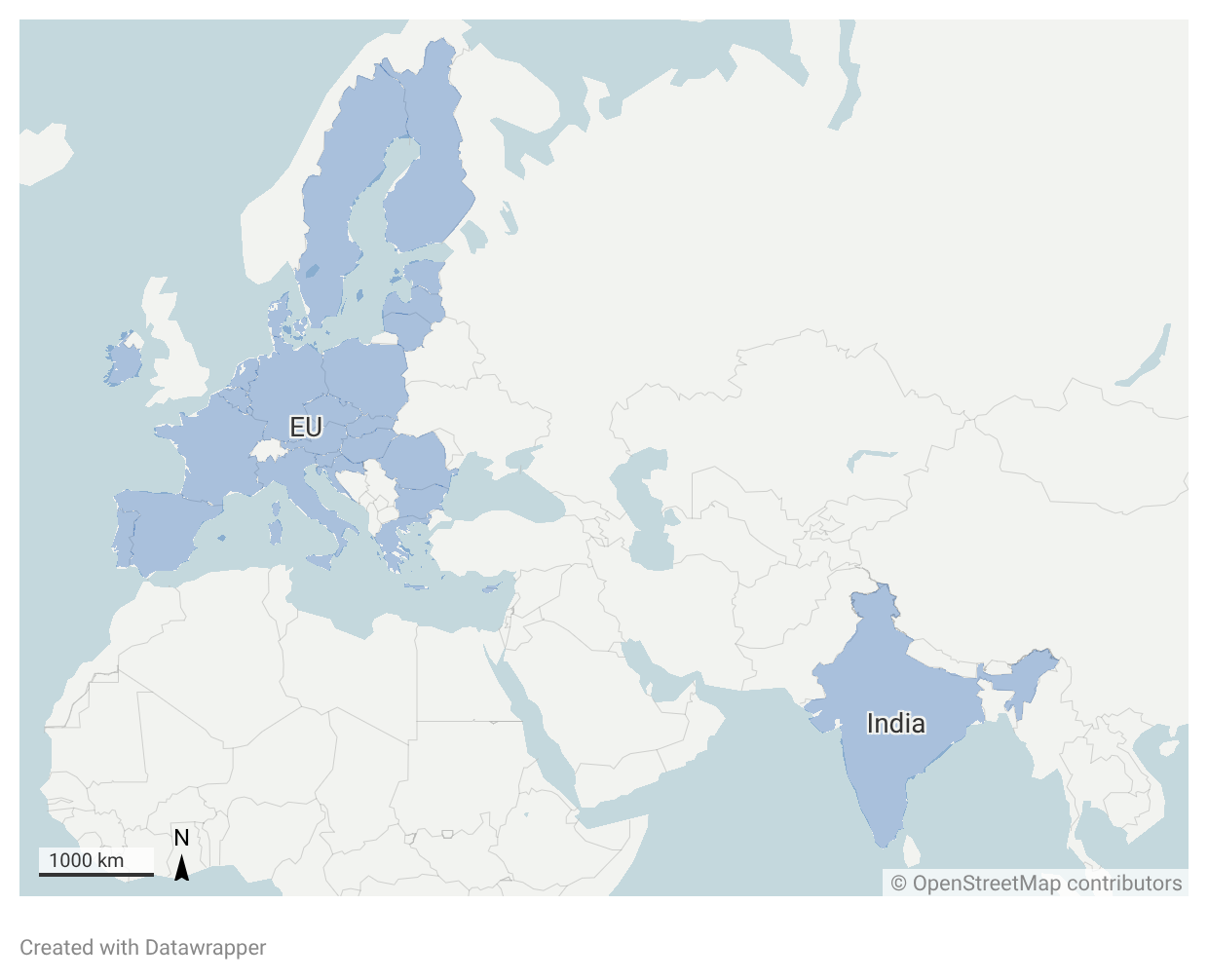

In January 2026, India and the European Union (EU) signed a landmark free trade agreement. The deal brings together approximately 2 billion consumers and accounts for a quarter of global GDP.

Beyond tariff cuts, the agreement aligns Indian production with EU regulatory standards, thus integrating India more into European and Asian supply chains and bilateral trade.

The deal, shaped by shifting geopolitical pressures, positions India as a key node in efforts by Europe and Asia to hedge against both China-related supply-chain risk and volatile US trade policy. The likely outcome is a more distributed, resilient production network across the Indo‑Pacific and Europe.

Context

On 27 January 2026, the European Union and India announced the “mother of all deals”—a comprehensive free trade agreement concluding nearly 2 decades of on‑and‑off negotiations. The announcement coincided with a high‑level EU visit to New Delhi aimed at deepening cooperation in trade, defence, and strategic affairs. Covering nearly 2 billion people and accounting for almost a quarter of global GDP, the agreement is vast in economic scope. Its strategic and geopolitical implications may prove equally significant.

The EU and India currently trade more than EUR 180b in goods and services annually — in 2024, India accounted for 2.4% of the EU’s total trade in goods. Projections suggest exports to India could double by the early 2030s as tariffs fall and regulatory barriers ease. The agreement significantly reduces duties on goods, opens services markets, and addresses non-tariff barriers, investment protection, intellectual property, and sustainable development. For European exporters, tariffs on nearly 97% of goods will be eliminated or reduced, while India gains preferential access for around 90% of its exports to the EU, notably in textiles, pharmaceuticals, steel, and engineering goods. A longstanding flashpoint—India’s highly protected automobile market—will partially open, with tariffs on European vehicles gradually falling to 10%, although electric vehicles remain excluded for 5 years to protect domestic producers.

Implications

By aligning Indian production with EU regulatory standards, the deal facilitates India’s integration into European and Asian value chains, reducing reliance on China as an intermediary processing hub. This is particularly consequential in pharmaceuticals, electric‑vehicle batteries, and green energy technologies, where regulatory compliance is both a market requirement and a competitive advantage. The likely outcome is a more distributed, resilient production network across the Indo‑Pacific and Europe.

Strategically, the agreement reflects a shared desire to diversify economic risk away from both China and, increasingly, the United States. For Europe, India is a large and fast‑growing market and a partner whose regulatory convergence can reinforce European standards globally. For India, deeper integration into Europe’s high‑value markets supports its ambition to emerge as a credible manufacturing and services hub within a multipolar economic order. Multinational brands, such as Zara and H&M, will be able to diversify production away from China as the deal reduces tariffs and trade barriers, enabling more efficient cross-border supply chains and market expansion.

The deal’s effects will extend beyond the signatories. Exporters across South Asia have warned that India’s preferential access to the EU will erode the advantages enjoyed by countries dependent on unilateral preference schemes. Bangladesh faces mounting pressure as it approaches graduation from least‑developed‑country status and the associated loss of Generalised System of Preferences (GSP) benefits. Increased Indian competition in garments and textiles now appears almost certain. The agreement opens new strategic options for firms in Japan, South Korea, and ASEAN states. Companies can relocate production to India while retaining preferential access to EU markets, enabling India to function as an integrated node rather than merely an export destination. For states navigating territorial disputes in the South and East China Seas, reduced dependence on China offers a measure of strategic insulation.

US protectionism and unpredictable policy choices under President Donald Trump have accelerated hedging strategies in both Brussels and New Delhi. India has faced some of the highest US tariffs, compounded by penalties on imports of Russian oil. In Europe, the US is increasingly viewed not merely as an unreliable partner but as a potential source of economic and geopolitical disruption. Against this backdrop, the EU–India agreement is as much a response to transatlantic uncertainty as it is to China.

In an era defined by protectionism and fragmentation, the EU–India deal offers a template for strategic hedging through openness—suggesting that, even amid geopolitical rivalry, ambitious economic integration remains both possible and consequential. The agreement will increasingly shape the concentration of production, capital, and talent. While India’s structural constraints remain real, the deal raises the cost of policy reversal on both sides and embeds India more deeply in Europe’s economic and strategic calculus. In doing so, it narrows the space for unilateralism—and reinforces the logic of economic alignment as a tool of geopolitical resilience.

European Union/Wikimedia

Forecast

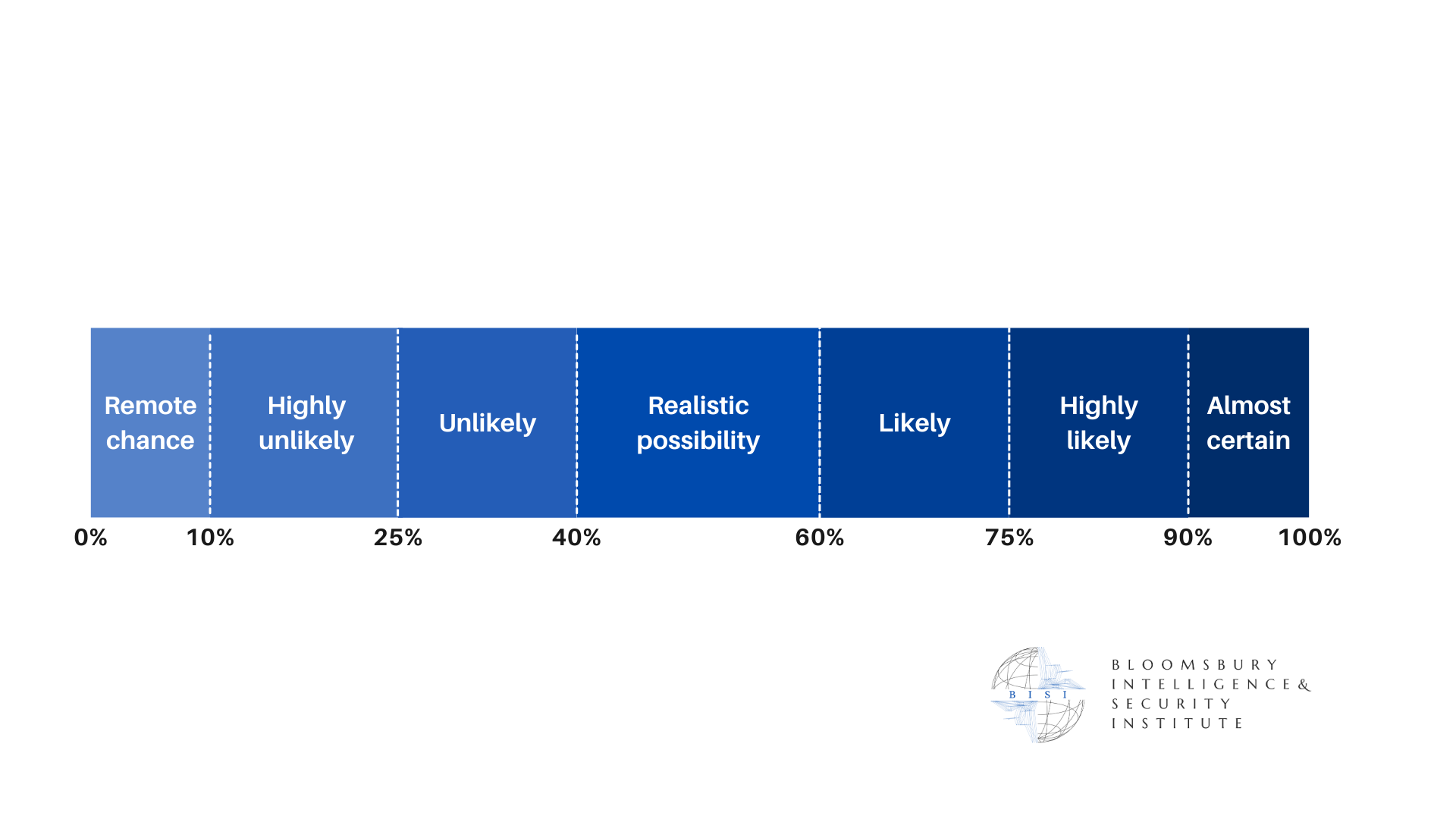

Short-term (Now - 3 months)

European manufacturers will likely test the Indian market cautiously, as residual tariffs, price-sensitive demand, and regulatory frictions continue to limit immediate scale—particularly in automobiles, where only premium segments are likely to see near-term gains.

Medium-term (3 - 12 months)

EU-India strategic engagement is highly likely to deepen, accelerated by US tariff-heavy and unpredictable trade policies and by growing EU interest in the Indo-Pacific as Washington’s focus narrows.

Long-term (>1 year)

India is likely to attract third-country capital seeking to diversify away from China-centric supply chains and to insulate itself from volatile .S trade policy. Across South Asia, the agreement will likely intensify competitive pressures—most notably on Bangladesh following LDC graduation—while reinforcing India’s competitive position in EU markets.