Saudi Arabia and UAE Rivalry: A ‘Cold War’ in the Middle East?

By Victoria Sainz | 10 February 2026

Summary

Saudi-UAE relations have shifted from partnership to rivalry, driven by opposing goals in Yemen and across the region.

This rivalry weakens the Gulf unity, fragments security and economic coordination, and prolongs regional instability.

A prolonged “cold war” dynamic is likely, with continued proxy competition and limited risks of direct conflict.

Context

What was a close and strategic relationship between Saudi Arabia and the United Arab Emirates (UAE) has deteriorated sharply in recent years, mainly due to differing ambitions in regional conflicts and competing visions for influence across the Middle East. Their cooperation in Yemen, which began in 2015 as part of a Saudi-led coalition to defeat the Iran-aligned Houthis, gradually fractured as Riyadh and Abu Dhabi chased incompatible objectives.

On one hand, Saudi Arabia has always supported the internationally recognised Yemeni government, which aims to preserve Yemen’s territorial unity and security within its own borders. On the other hand, the UAE shifted to back the Southern Transitional Council (STC), the southern separatist movement which seeks autonomy and control over strategic ports and trade routes. The divergence deepened tensions as Saudi Arabia had concerns that the UAE-linked forces were working to weaken the anti-Houtis coalition and divide Yemen. On January 2nd 2026, Saudi Arabia carried out airstrikes on UAE-backed forces, killing 20 separatist fighters. This signals the seriousness of the rift.

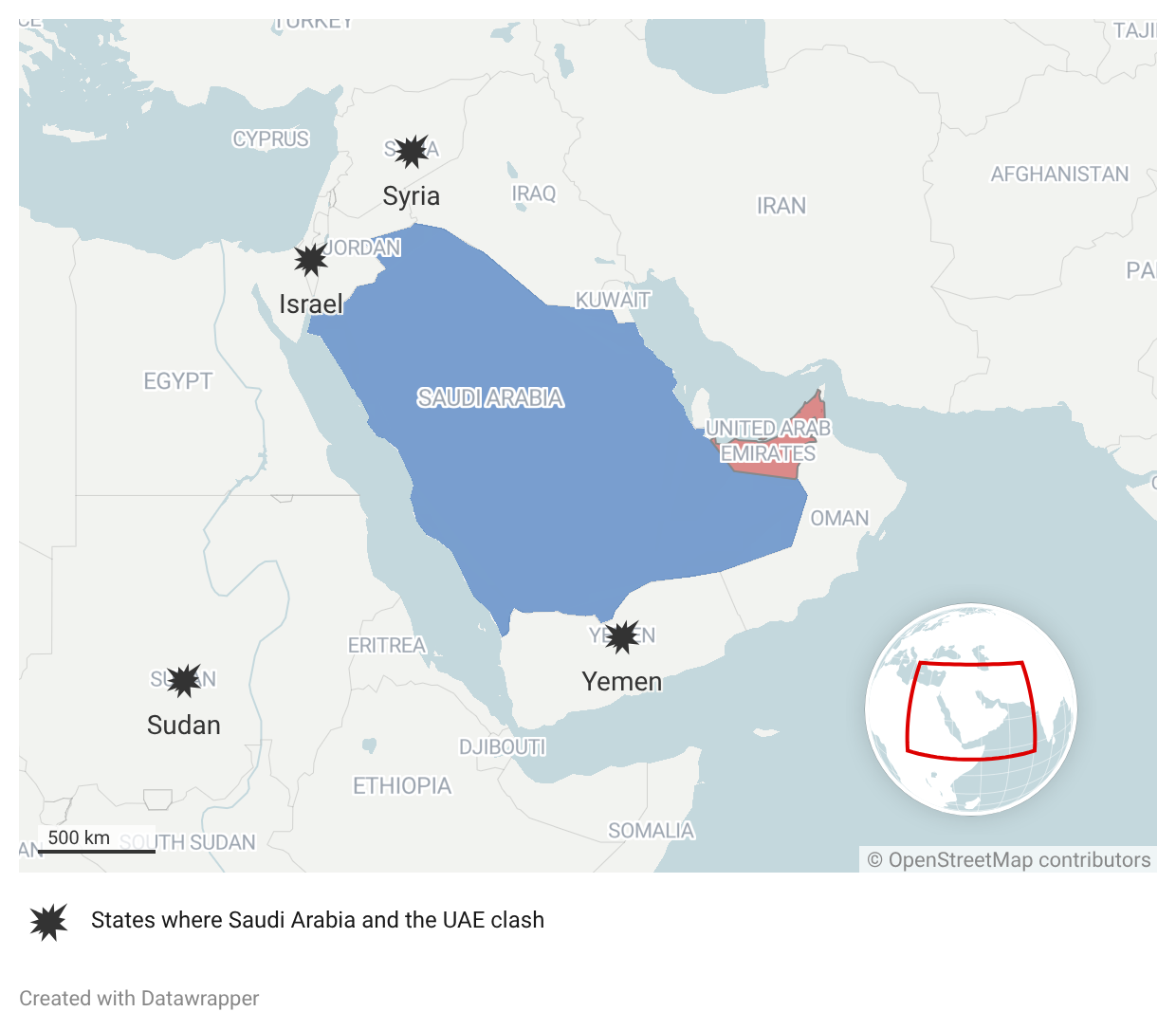

Similar rivalries are visible in other states such as Syria, Israel, and parts of the Horn of Africa, where Riyadh and Abu Dhabi back different actors to secure strategic footholds.

Implications

The Saudi-UAE rivalry has contributed to deteriorating diplomatic relations and the erosion of Gulf unity. This weakens the coherence and credibility of the Gulf Cooperation Council (GCC), as the states increasingly pursue competitive leadership roles in the region. As seen in Yemen, divergent foreign policies have exposed strategic mistrust and reduced coordination, complicating collective decision-making on regional crises.

Operationally, the rivalry has reduced coordination and efficiency across military and commercial sectors. Competition over logistics and infrastructure developments has created parallel ports, transport corridors, and supply chains, increasing duplication and operational frictions. In conflict zones in Yemen, support for proxy rival forces has fragmented the country and command structures, prolonging instability. These dynamics have also disrupted global trade, particularly maritime shipping routes, complicating security and logistics alongside critical naval corridors, such as the Suez Canal.

The security implications of this competitiveness are severe. The economic aid and arms trade race between Saudi Arabia and the UAE has intensified conflicts that neither side can fully control and that do not seem to end. The arming of competing allies in Yemen has weakened incentives for compromise, disrupted command and control, and raised the possibility of intra-coalition conflicts. Riyadh and Abu Dhabi have decreasing leverage, increased escalation risks, and an increasing potential of direct confrontation as local parties acquire independent military capability, further undermining regional security.

Economically, the situation has reinforced a zero-sum competition for capital, trade, and foreign investment rather than regional complementarities. Parallel mega-projects and infrastructure initiatives risk inefficient capital allocation and long-term overcapacity, but they can potentially generate short-term employment. As Saudi Arabia and the UAE compete to dominate logistics, finance, energy hubs, etc., fragmentation increases transaction costs and weakens regional market integration. Over time, this duplication may reduce investor confidence and constrain diversification efforts.

Forecast

Short-term (Now - 3 months)

Following the airstrikes in January 2026, Saudi Arabia and the UAE are likely to experience heightened political and media tensions as they attempt to demonstrate their resolve and discourage additional interference.

It is highly likely that competition through local fighters in Yemen continues, particularly around strategic ports and transport corridors, while direct and sustained bilateral military confrontation remains unlikely.

It is a realistic possibility that regional or international actors attempt limited mediation efforts, although these initiatives appear unlikely to produce rapid de-escalation.

Medium-term (3-12 months)

It is likely that the rivalry becomes more structured across multiple theatres, including Yemen, the Horn of Africa, and parts of the Levant, with both states consolidating influence through local partners and economic tools.

It remains a realistic possibility that additional limited incidents occur between Saudi-and UAE-backed forces. However, a sustained confrontation stays unlikely.

Long-term (>1 year)

It is likely that a long-lasting “cold war” dynamic is going to solidify, marked by rival security alliances and competing economic corridors.

Given the continued duplication of infrastructure and investment strategies, it is very likely that regional economic and security integration will continue to fragment.

A direct conflict between the two states is unlikely as the political, economic, and strategic costs of open conflict continue to outweigh the advantages. Instead, both sides are encouraged to compete below the line of open war.