Gulf states anchoring de-escalation with Iran amid regional and external pressures

By Trishnakhi Parashar | 16 February 2026

Summary

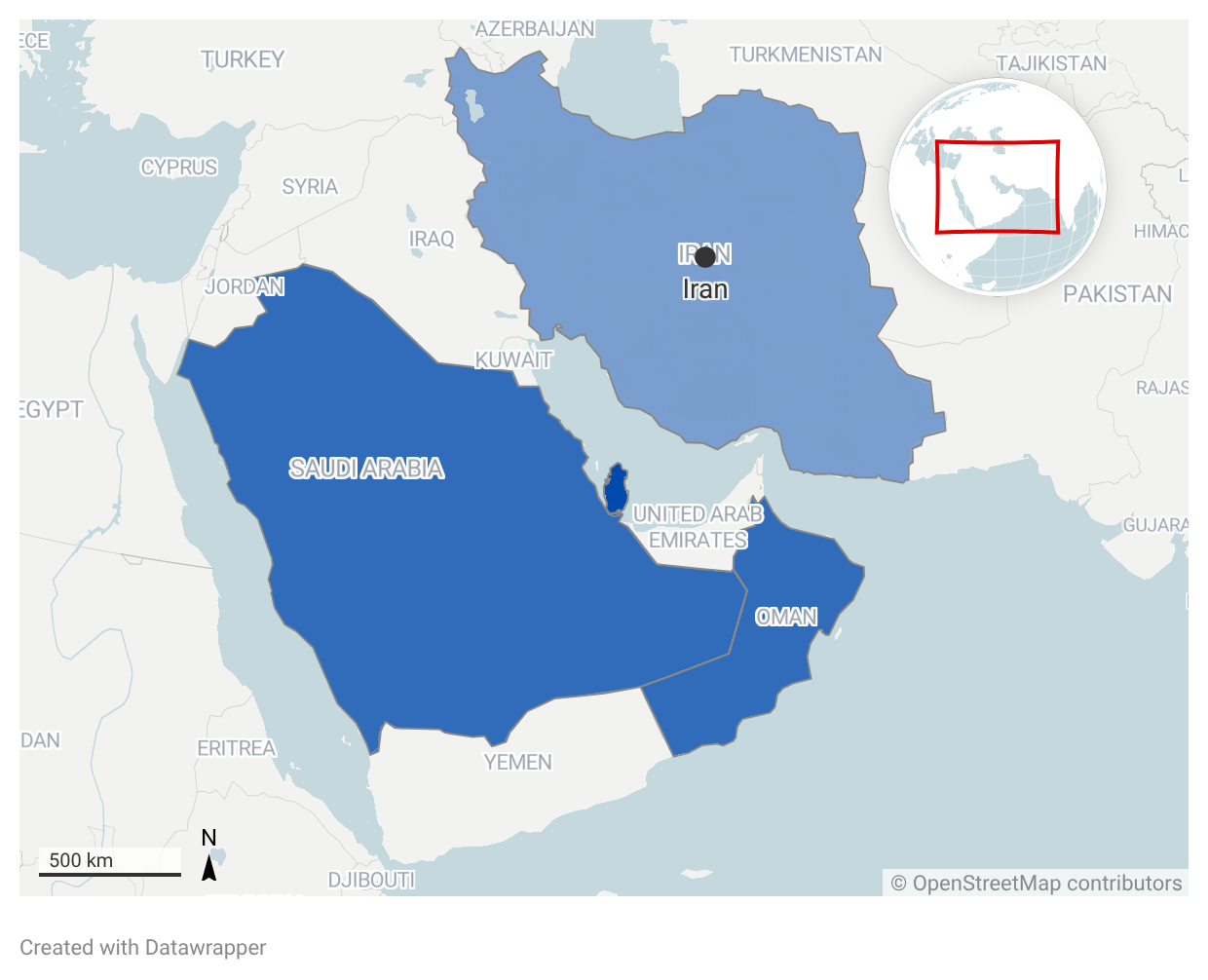

Arab Gulf nations and Iran have pushed de-escalation through diplomatic engagements, which include restoring diplomatic ties (Saudi-Iran détente), high level ministerial talks on regional security involving Saudi Arabia, Omani, and Qatari foreign ministers.

Gulf nations have been lobbying to reduce tensions between the United States and Iran to avoid being drawn into a regional conflict.

Despite open diplomatic channels, deep-seated mutual distrust persists, particularly on security intentions, due to Iran’s indigenous missile developments and its support for regional proxies like the Houthis.

Context

With the escalation of tensions across the Middle East and the prospect of US military action against Iran looming over the Gulf, regional security dynamics have entered a state of precariousness. Under such circumstances, Arab Gulf states have markedly augmented their diplomatic engagement with Tehran. Saudi Arabia and Iran have pursued a protracted détente, culminating in the restoration of formal diplomatic ties after years of estrangement. Moreover, on 15 January 2026, high-level ministerial talks took place involving the foreign ministers of Saudi Arabia, Oman and Qatar, focusing on regional security and stability. On 10 January 2026, Oman’s foreign minister made a visit to Tehran, whilst Qatari prime minister Mohammed bin Abdulrahman Al Thani and minister of foreign affairs discussed regional de-escalation efforts during a meeting on 31 January 2026, with Secretary of Iran’s Supreme National Security Council, Ali Larijani. These dialogues highlight a concerted regional effort to forestall the risk of broader conflagration.

Broader geopolitical pressure has prompted the Arab Gulf states to leverage their access to both senior Iranian officials and the US. Explicit threats to US bases in the region exacerbate the peril of strategic miscalculation. Any escalation by the US and Israel would plausibly provoke reprisals from Iran and its proximate actors, which potentially lead to a wider regional war. Reports later revealed that ongoing diplomatic engagements by the concerned states dissuaded the US from authorising a strike on Iran. However, Iran’s Supreme Leader Ayatollah Ali Khamenei’s latest speech on a potential war and President Donald Trump’s remark, 'we'll find out' on the nuclear deal, send mixed signals.

Despite these engagements, Gulf states increasingly perceive Iran through a cautious lens. Iran is currently witnessing chronic misgovernance, soaring inflation, declining living standards, and a high level of fatalities. Past crises involving Iran have shown that escalations rarely stay confined to Iran alone and often risk neighbouring states. On 23 June 2025, Iran’s missile actions aimed at the US base in Qatar drew widespread condemnation from Arab states. Moreover, its nexus with the Houthis possesses an additional layer of distrust among Gulf states. Tehran has been accused of providing political, logistic and military support to the Houthis in Yemen. Yet, Gulf states are actively balancing deterrence because direct military confrontation could impact their energy security, the safety of maritime channels, and trade and investment flows in the region. Moreover, involvement in a crisis or even a war-like situation would be counterproductive to any national interest.

Implications

Gulf states' effort to anchor de-escalation with Iran projects a pragmatic political calculation intended for reducing exposure to regional crises. This conflict prevention initiative is driven by the assessment that the collapse of the current Iranian regime, a forced change or a power vacuum could lead to fragmentation and prolonged instability, compelling Gulf nations to recalibrate their regional and international political priorities. The political implications of the current de-escalation effort show an important shift towards diplomacy and risk management. The states are gradually moving away from rigid alignments with either side and selectively choosing to negotiate with both parties while safeguarding their sovereignty. Consistent diplomatic engagements have helped lower overt tension, but the potential for deterioration cannot be ignored.

From the operational perspective, risk remains high due to increasing military posturing by the US and Iran, and the informal nature of the existing de-escalation mechanisms. The series of discussions led by Gulf states and indirect information exchanges between Tehran and Washington are inherently informal. The absence of a formally institutionalised crisis management framework amplifies the likelihood of broader operational disruptions. Logistics and commercial shipping remain vulnerable to maritime disruptions, though gradually recovering, are still exposed to operational challenges at sea.

Any US strike on Iran would not have been confined to Iranian territory but would have generated far-reaching transboundary repercussions with significant security implications. Trump’s decision not to proceed with military action has slightly eased immediate security concerns. However, the US deployed a range of military assets to the Middle East, increasing military presence and surveillance near Iran. In response, Iran confirmed that naval drills near US warships in the Strait of Hormuz signals both states' readiness if tensions escalate in future.

If any escalation were to break out between the US and Iran, the economic implications would be profoundly serious. The Arab Gulf region is evolving into a dynamic economic landscape, driven not only by its oil industry but also by entrepreneurial ventures, tourism, and the entertainment industry. Economically, the stakes for the region being dragged into a prolonged conflict are too high. De-escalation has renewed the investors’ confidence; however, uncertainty surrounding the US-Iran related tension continues to pose a potential threat to energy exports, shipping routes and logistic operations, which account for a significant share of the regional economy. Recently, the US has imposed new sanctions on Iran’s oil sector, complicating the Gulf efforts and limiting prospects of short-term economic easing in Iran.

Forecast

Short-term (Now - 3 months)

Arab Gulf states will highly likely continue active diplomatic engagement with Iran and the US to contain further escalation risk in the region.

Although Trump decided against military strikes on Iran, the parallel bolstering of defence assets is likely to sustain severe uncertainty, influencing Iran’s security and political concerns. Similar strategic preparedness is also at play in Iran.

The US-Iran meeting in Oman on 6 February 2026 is likely to serve as a diplomatic opening focused on nuclear diplomacy and confidence building rather than immediate advances. It likely reduces the risk of short-term escalations.

Medium-term (3 - 12 months)

There is a realistic possibility that the US will continue to use the Gulf diplomatic channel to manage tensions.

Arab Gulf states are unlikely to achieve substantive confidence building or a formalised security framework between the two parties.

Energy and maritime security will likely remain fragile. Uncertainty increases the possibility of disruption to shipping routes connected to the Strait of Hormuz and nearby Gulf corridors.

Long-term (>1 year)

Without a formal binding framework, Iran will likely remain a structural driver of regional uncertainty. In the long term, the US bases and networks will continue to be in a vulnerable position.

If diplomatic channels fail to produce tangible advancements, the US is likely to consider a limited strike to put pressure on Tehran.

De-escalation between Arab Gulf states and Iran is likely to persist; however, indirect rivalry and proxy activities will likely continue.