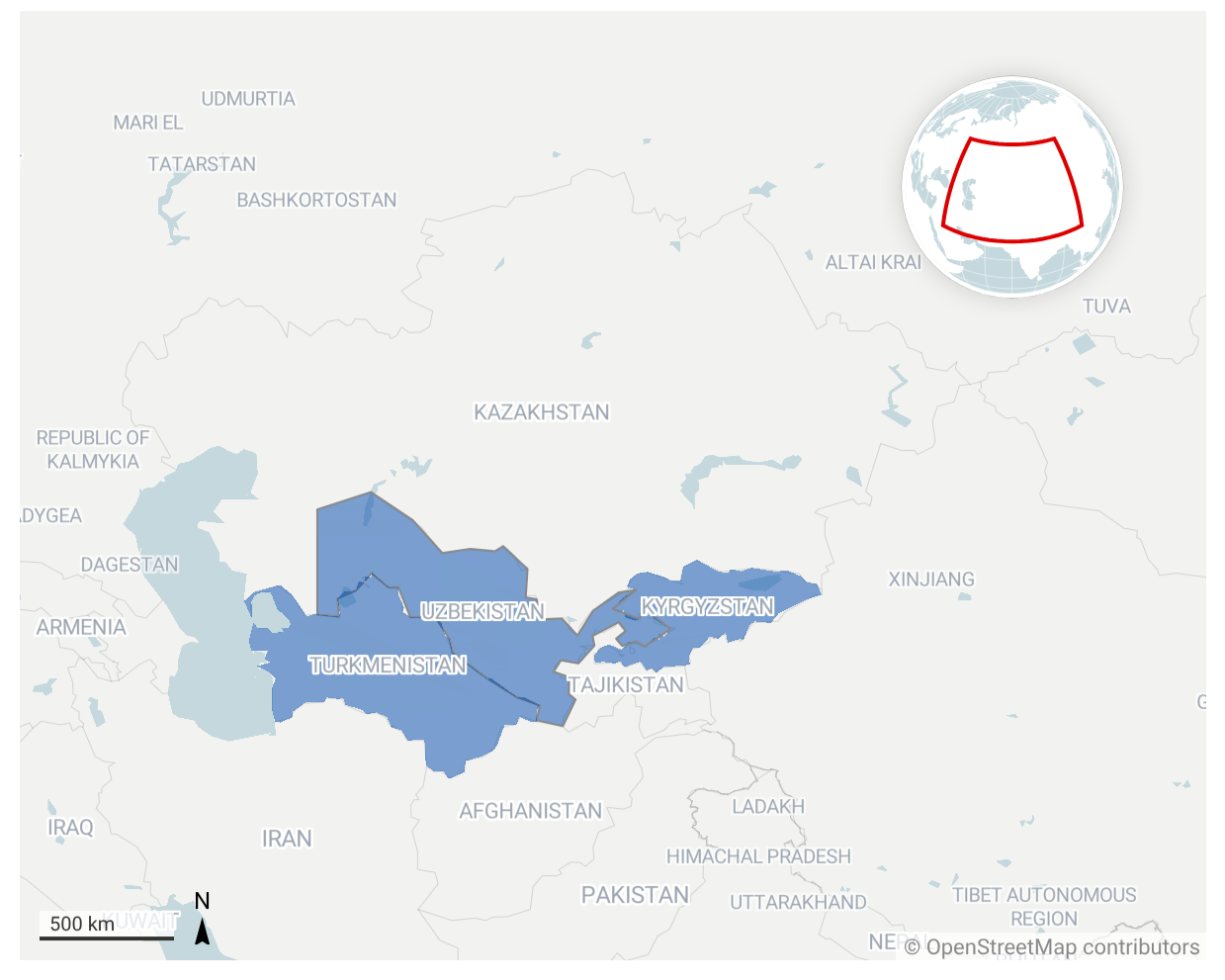

Central Asia’s Cryptocurrency Pivot: New Opportunities, New Risks

By Erlan Benedis-Grab | 9 February 2026

Summary

Stablecoins (a type of cryptocurrency designed to maintain a stable value by pegging themselves to external assets, usually fiat currencies like the U.S. dollar) are growing fast in Central Asia and matter for states because they enable cheap, quick cross-border payments without the usual crypto price swings.

In Central Asia, governments are adopting crypto policy as part of broader state-led digitisation efforts, but they are doing so cautiously —allowing digital assets only within tightly controlled frameworks.

Cross-border needs and sanctions risk will shape what happens next. Remittances make interoperable crypto rails economically attractive, but Russia-linked sanctions-evasion concerns will draw Western scrutiny and likely push Central Asian states toward tighter compliance signalling and controlled growth.

Context

In 2025, Stablecoin’s share of the crypto market surged by 52%, underscoring its growing importance in the crypto landscape, not only for individuals but also for nations. Stablecoins are usually pegged to the U.S. dollar, but can also be tied to gold, the euro or the ruble. Crucially, stablecoins offer a digital method for payments quickly and cheaply across borders without the issue of typical crypto volatility.

Overall, these measures fit within broader state-led efforts to modernise the digital economy and expand e-government across Central Asia. The region’s rapid shift toward app-based finance illustrates this trend. In Kazakhstan, Kaspi is the country’s most widely used banking platform and is primarily accessed through its mobile app. At the same time, governments across the region have spent the past decade modernising public administration, expanding e-government services, and launching “digital economy” initiatives to attract investment.

Crypto policy is now being folded into that modernisation story. However, rather than embracing open capital flows or decentralised finance, states are selectively permitting digital assets, although at different levels

Implications

Turkmenistan has introduced opportunities for individual entrepreneurs to benefit from crypto mining and exchange cryptocurrency. However, the country's crypto development is lagging due to its strict government oversight. The Turkmen government does not treat crypto as everyday money, and its practical scope remains limited by low adoption among citizens. This showcases how some Central Asian governments remain reluctant to push for full adoption.

In Uzbekistan, by contrast, the state has moved beyond ambiguity and tried to domesticate crypto through the law. In 2023, Uzbekistan legalised the buying and selling of cryptocurrency, but only through strictly regulated domestic providers. Now, Uzbekistan’s President Mizaryov is prepared to take the next step, but is treating reform like an experiment. Uzbekistan's “special legal regime” containing a "regulatory sandbox” explicitly states that cryptocurrency is still not a form of legal tender, except in this special sandbox situation. The procedure and duration are to be set later by the National Agency of Prospective Projects of the Republic of Uzbekistan (NAPP) together with the Central Bank. Additionally, Uzbekistan’s Central Bank began studying models for a “digital soum” (a CBDC, i.e., state-issued central-bank money). Generally, Uzbekistan is taking a cautious but experimental approach – allowing limited room for testing within regulatory sandboxes but under strict government control.

Kyrgyzstan may offer the most intriguing case. In November 2025, the government launched USDKG, a gold-backed stablecoin with a 1:1 peg to the U.S. dollar. This places Kyrgyzstan among a rare bunch of states attempting to pair commodity backing with a dollar anchor in a digital format. departs from mainstream post-Nixon monetary orthodoxy, which generally relies on fiat currency. This is potentially significant because gold-backed currency departs from fiat orthodoxy, though the dollar peg means Kyrgyzstan is experimenting at the margins rather than truly abandoning the system.

These reforms may seem counterintuitive: cryptocurrencies are often associated with open capital flows and decentralised finance, yet in Central Asia, they are being introduced through tightly controlled sandboxes and licensing regimes designed to preserve state control. It is imperative for crypto to function beyond borders. Central Asia has some of the world’s highest remittance rates (sending money back to your family from abroad), making the cross-border ease of crypto not just desirable but economically essential to the functioning of Kyrgyzstan

Crypto has been used as a channel for Russian sanctions evasion, and Western policymakers will watch Central Asia’s crypto and stablecoin frameworks closely. For example, a Kyrgyzstan-registered stablecoin project, A7A5, reportedly backed by a Moldovan oligarch, has faced intense scrutiny in Western reporting and enforcement discussions. These stablecoins are not isolated from the real economy; yet if they scale and gain official backing, they could evolve into government-tolerated (or even government-supported) channels that further Russia’s sanction evasion. This ruble-backed was used to move about $93 billion worth of money on crypto networks in less than a year.

Forecast

Short-term (Now - 3 months)

It is likely that Uzbekistan will fully introduce its rules and regulations for the crypto special regime.A small set of approved exchanges/custodians/payment partners emerge inside the special regime connected to the government.

Turkmenistan’s crypto usage is likely to remain largely symbolic: limited permissions exist, but real adoption will stay low.

Medium-term (3-12 months)

A7A5-style headlines are likely to drive more Western compliance pressure and local “reassurance” moves (statements, tighter oversight, or quiet restrictions).

It is likely that remittances and cross-border usage are likely to grow through crypto-based regulated rails, often involving lighter or more streamlined KYC (know-your-customer) than traditional banking channels.

Long-term (>1 year)

There is a realistic possibility that Turkmenistan will follow Uzbekistan’s example, by partly legalizing crypto for payments.