Balancing Security and Influence in the Renewed US-Saudi Partnership

By Victoria Sainz | 17 December 2025

Summary

Renewed US-Saudi engagement reflects Washington’s return to Gulf partnerships and Riyadh’s push to revive Vision 2030.

The meeting elevates Saudi influence, deepens defence and tech cooperation, and ties security alignment to major Saudi investments.

Near-term consolidation is highly likely, operational expansion is likely, and long-term regional militarisation is a realistic possibility.

Context

On 18 November 2025, United States (US) President Donald Trump held a meeting in Washington DC, with Saudi Crown Prince Mohammed Bin Salman (MBS), where the two leaders mainly discussed military and economic matters. This meeting was seen as quite controversial due to Saudi Arabia’s multiple human rights violations, adding significant public scrutiny and political sensitivity to the encounter. This meeting signals a willingness to move forward with a diplomatic bilateral relationship between the USA and Saudi Arabia.

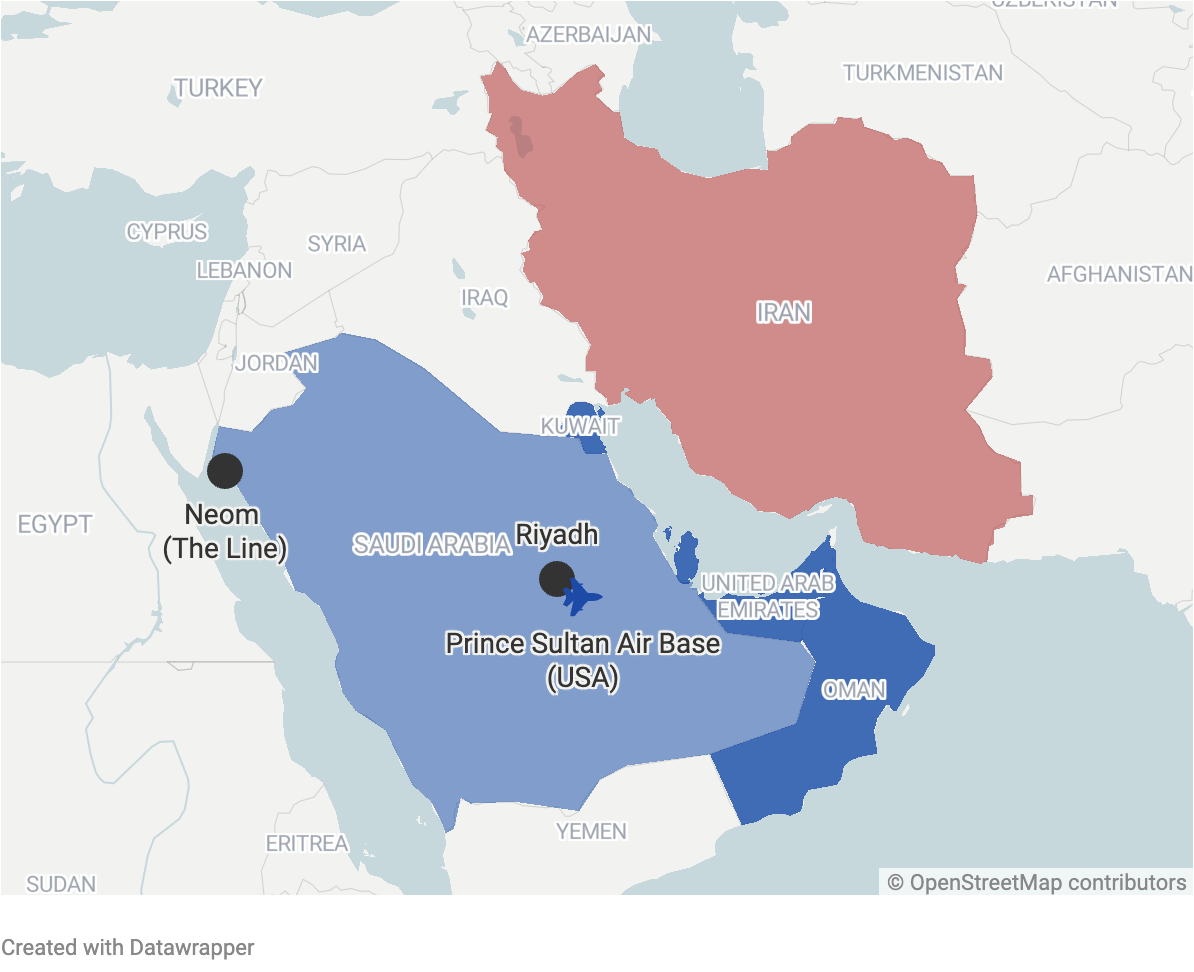

From the Saudi part, this stems from MBS’s “Vision 2030”, a plan that aims at diversifying the economy, enhancing government efficiency and establishing the Kingdom as a global leader. However, the decade-old project seems to be stalling as MBS has been financing never-ending and incredibly expensive projects, such as “The Line” in Neom, which faces delays and cost overruns.

From the US side, this meeting comes from President Trump's desire to re-establish strong strategic ties in the Middle East with resource-rich nations, ensuring a reliable oil supply for American interests, securing massive arms sales that support the US defence industry (USD 142 billion deal), and counterbalancing regional rivals like Iran.

Implications

Politically, this meeting marks a symbolic rehabilitation of SA-US ‘corridor powers’: raising MBS’s international standing after years of strain. By strengthening ties with Riyadh, the US signals a renewed pivot towards traditional Gulf allies in its Middle East policy, potentially reshaping regional alignments. This could increase Saudi influence as a regional power-broker for Washington DC. The rapprochement may also set the stage for a broader US Middle East strategy where transactional diplomacy (security + economics) overrides previous emphasis on human-rights violations and governance conditionality.

The agreement reportedly includes a defence deal and large-scale arms sales (such as advanced combat F-35 jets) from the US to Saudi Arabia, showing willingness to deepen operational military cooperation and capacity building. There is likely to be an expansion of joint exercises, military training, intelligence exchanges, and procurement, effectively re-shoring US military influence and readiness in the Gulf region. The linkage of operational cooperation with technology and defence-industrial collaboration (such as drones, AI, civil nuclear cooperation) suggests long-term integration beyond mere arms sale- embedding Saudi forces in US-oriented doctrine and equipment.

From Saudi Arabia’s perspective, US security guarantees and advanced weaponry significantly boost its defence posture in an unstable region, especially vis-à-vis regional rivals or threats. For the US, renewed regional leverage, enabling Washington D.C. to project power in the Gulf, counterbalance adversaries, and deter threats through strengthened partners. However, deeper militarisation raises risks: escalation of the arms race in the region; potential blowback if advanced systems are misused; and complications, especially concerning conflicts and rivalries.

A central feature of the meeting is a massive Saudi investment pledged to the US economy (almost USD 1t). If realised, this could spur US growth, create jobs, and deepen financial ties. Beyond investments, the agreement expands cooperation into civil nuclear energy, technology, critical minerals, and AI: diversifying bilateral trade and economic interdependence beyond oil and arms.

White House

Forecast

Short-term (Now - 3 months)

Strengthening of the bilateral partnership is highly likely if both sides move to formalise defence and investment commitment.

Early announcements highlighting Saudi financial pledges and US economic gains are likely, while sustained public criticism over human rights issues is unlikely to alter policy trajectories.

Regional actors are unlikely to challenge the shift directly in the immediate term, though heightened monitoring is a realistic possibility

Medium-term (3-12 months)

Expansion of operational military cooperation, including joint exercises and advanced procurement processes, is likely.

A gradual increase in Saudi regional influence is likely, prompting strategic recalibration by Iran and some Gulf neighbours.

Delays or inflation in Saudi mega projects affecting US commercial involvement are a realistic possibility.

Long-term (>1 year)

Entrenchment of a durable US-Saudi security axis, with deeper integration of Saudi forces into a US-aligned structure, is likely, and a more assertive Saudi regional posture shaped by enhanced capability is likely.

The risk of a regional arms race is a realistic possibility, while unintended consequences from the use of advanced systems in regional conflicts are also a realistic possibility.

Sustained Saudi investment shaping some US economic sectors is likely, though full delivery of Vision 2030-linked commitments is a realistic possibility rather than assured, constrained by domestic, fiscal, and governance pressure.