Trump’s Tariffs Target India's Russian Oil Imports

By David Yang | 3 September 2025

Summary

United States (US) President Donald Trump imposed 50% tariffs on Indian imports, citing India’s tariffs on US goods and its large purchases of Russian oil since the 2022 Russian invasion of Ukraine.

Since the G7 and European Union (EU) imposed a USD 60 per barrel price cap on Russian seaborne crude oil in September 2022, India has increased its imports of Russian crude oil, replacing declining Western demand and buoying Russia’s oil revenues. Although Indian buyers of Russian crude have mostly complied with the price cap and further US sanctions on Russian tankers, Trump’s tariff seeks to reduce the US’ trade deficit with India and pressure Russia’s oil revenues.

50% tariffs outweigh the benefit of the oil discount, making it likely that India will take steps to reduce reliance on Russian energy. However, in the medium term the move will undo efforts to increase Indian cooperation with the West.

Trump’s 6 August announcement of 50% tariffs on Indian imports, the joint highest rate of any country alongside Brazil, marked the latest escalation in US-India trade relations. Trade negotiations had been ongoing since the “Liberation Day” tariffs in April, which were levied at 25%. The latest threatened rates, which went into effect on 27 August, were justified as “sanctions” on India over purchases of Russian crude oil following its invasion of Ukraine.

India emerged as a major importer of Russian oil as Western demand plummeted after Russia’s invasion of Ukraine. The fall in demand dropped Russian Urals crude (the main blend of Russian oil) prices relative to other suppliers, which has a price cap of USD 60 per barrel imposed by the G7 and EU. Enforced by banning Western insurers, which dominate the market for insuring oil tankers, from providing their services to tankers selling Russian oil at over USD 60 per barrel, the discount on Russian oil grew. India was quick to take advantage of the cheap Russian oil, increasing its import share of Russian oil from 0.2% of crude imports before the war to around 35-40% in 2025. Furthermore, India has been accused of mixing Russian crude into its refined oil production to bypass Western sanctions, of which 1.4m barrels per day are exported to destinations including the EU.

The Indian government took a strong stance to the tariffs, with Prime Minister Narendra Modi claiming to be ready to “pay a very heavy price”. The opposition has seized on the tariffs to rally national pride, placing pressure on Modi, who has defined his government by Hindu-nationalism, not to back down. Government officials have stated that India will continue to purchase Russian oil, despite reports that state-owned refiners are cutting back on demand and seeking to diversify their sources.

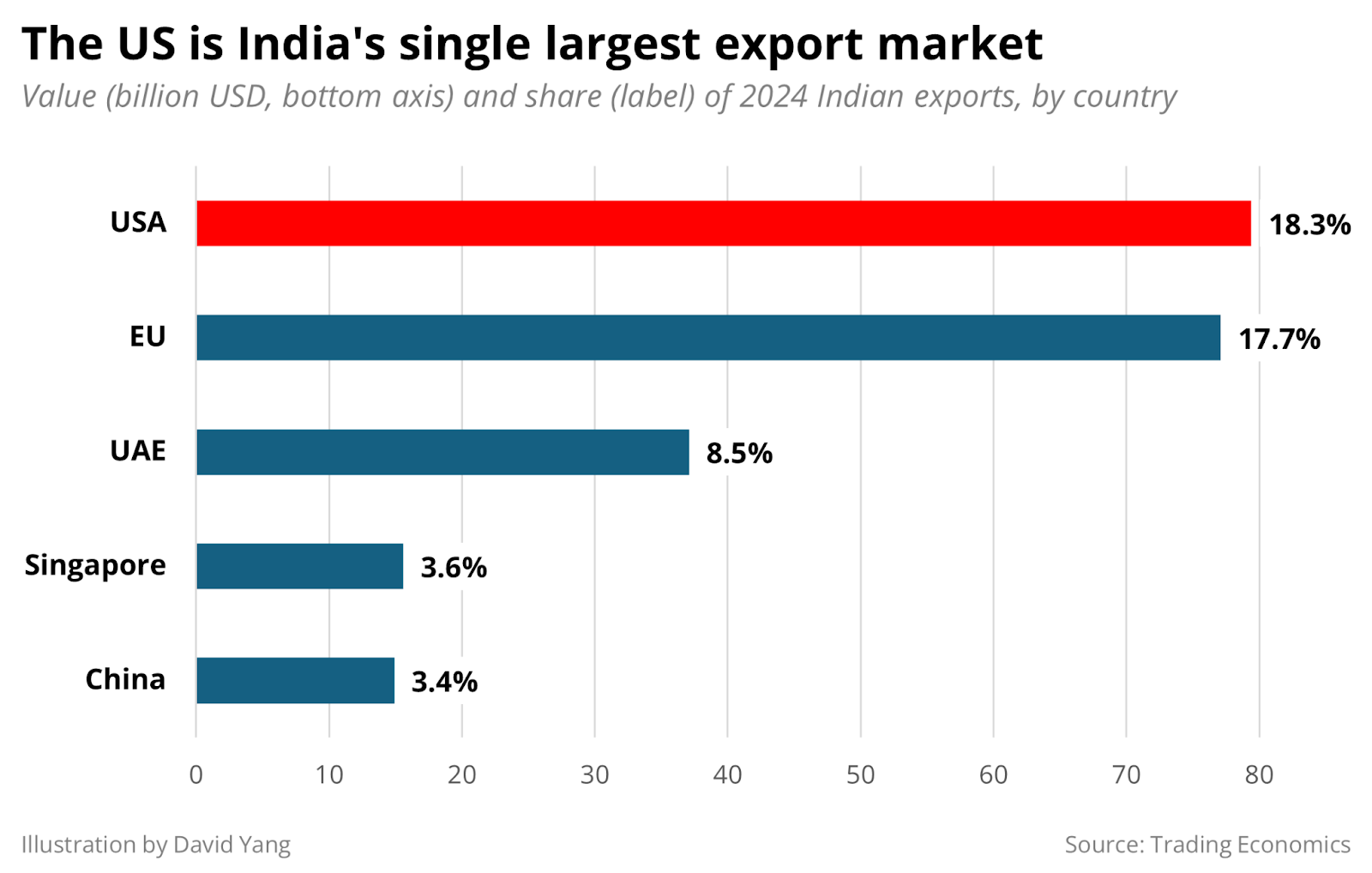

Despite Modi’s hardline rhetoric, the economics favour conceding to the US. India’s savings from Russian crude’s discount relative to global supply in the first quarter of 2025 is estimated at USD 3.8b. Yet, India exported USD 87 billion to the US in 2024, making up 18% of India’s exports and 2.2% of GDP, all of which is at risk as Indian exporters claim they can only absorb tariffs of 10-15%. Economists forecast that the tariffs could shave 1% off of India’s forecasted 6.3% GDP growth this fiscal year. With the Urals discount continuing to narrow, the opportunity cost of reducing reliance on Russian oil grows increasingly marginal compared to the risk of additional 50% tariffs.

However, India will not be able to immediately cut its reliance on Russian oil due to its scale. If India were to suddenly seek to replace all of its 1.8m barrels per day of Russian crude imports, the increased demand for alternative supply would likely drive up global oil prices, something Trump is eager to avoid. Even with the 50% tariffs taking effect, India continues to push for a deal with Trump, making an eventual deal more likely than not. Given a shared interest in a more gradual adjustment, it is likely that the US and India will reach an agreement in which India gradually reduces its purchases of Russian crude oil, while the US lowers its tariffs. This would provide the Modi government with the grounds to appease domestic political pressure through a more subtle, protracted adjustment while still achieving Trump’s aim of reducing India’s Russian crude imports without spiking oil prices.

However, Trump’s escalatory threats risk undermining the process of US-India security and economic cooperation. Trump touted his strong personal relationship with Modi, and former US President Joe Biden made great efforts to cooperate with India on competing with China, strengthening its membership in the Quad group and technology partnerships. Yet in the wake of the tariff threats, India-China relations have warmed as the two countries find partners to combat US “bullying”. The two countries have agreed to resume trade and visa issuance, and settle their border disputes that have periodically flared into small arms clashes. While India and China remain competitors on the global stage, making deep alignment unlikely, improving relations with China could be perceived as India's foreign policy mitigation, as Trump’s policy has been unpredictable since assuming his second term. Thus, Trump risks alienating an important partner in the US’ competition with China.

Kremlin/Wikimedia, CC BY 3.0

Forecast

Short-term (Now - 3 months)

The damaging effects of 50% tariffs on India’s export sector make it likely that Indian negotiators will rush to at least delay the imposition of tariffs in the coming months. A temporary deal is a realistic possibility which would grant reprieve for the Indian economy.

Medium-term (3-12 months)

Indian refiners will likely gradually reduce their purchases of Russian crude oil through the rest of 2025 and 2026 from unofficial state guidance. Over time this will diminish Russia’s oil revenues as India makes up such a large share of consumption that China and other Russian allies will struggle to replace.

Modi’s rhetoric will likely remain combative throughout and after the negotiation process as he seeks to avoid the perception of backing down.

Long-term (>1 year)

India is very likely to remain durably sceptical of US efforts to secure security cooperation in the Indo-Pacific throughout the rest of Trump’s term, and likely beyond. Ties will warm with China to a limited extent given underlying competition, but India will more broadly seek partnerships with other states to hedge its exposure to the US.