Commonwealth of Independent States Summit: An Evaluation of Russia's Declining Regional Influence

By Marina Gruzer | 21 October 2025

Summary

Putin’s visit to Tajikistan aimed to reaffirm Russia’s economic influence in Central Asia amid growing competition from China’s Belt and Road investments and the EU’s Global Gateway initiatives.

Despite limited investment capacity, Russia maintains significant leverage through labour migration and remittances, with Central Asian states signing new migration and transport cooperation agreements to sustain economic ties.

While the CIS summit produced multiple agreements on energy and security cooperation, Russia’s ability to uphold its regional security role is increasingly constrained by the ongoing war in Ukraine and resource limitations.

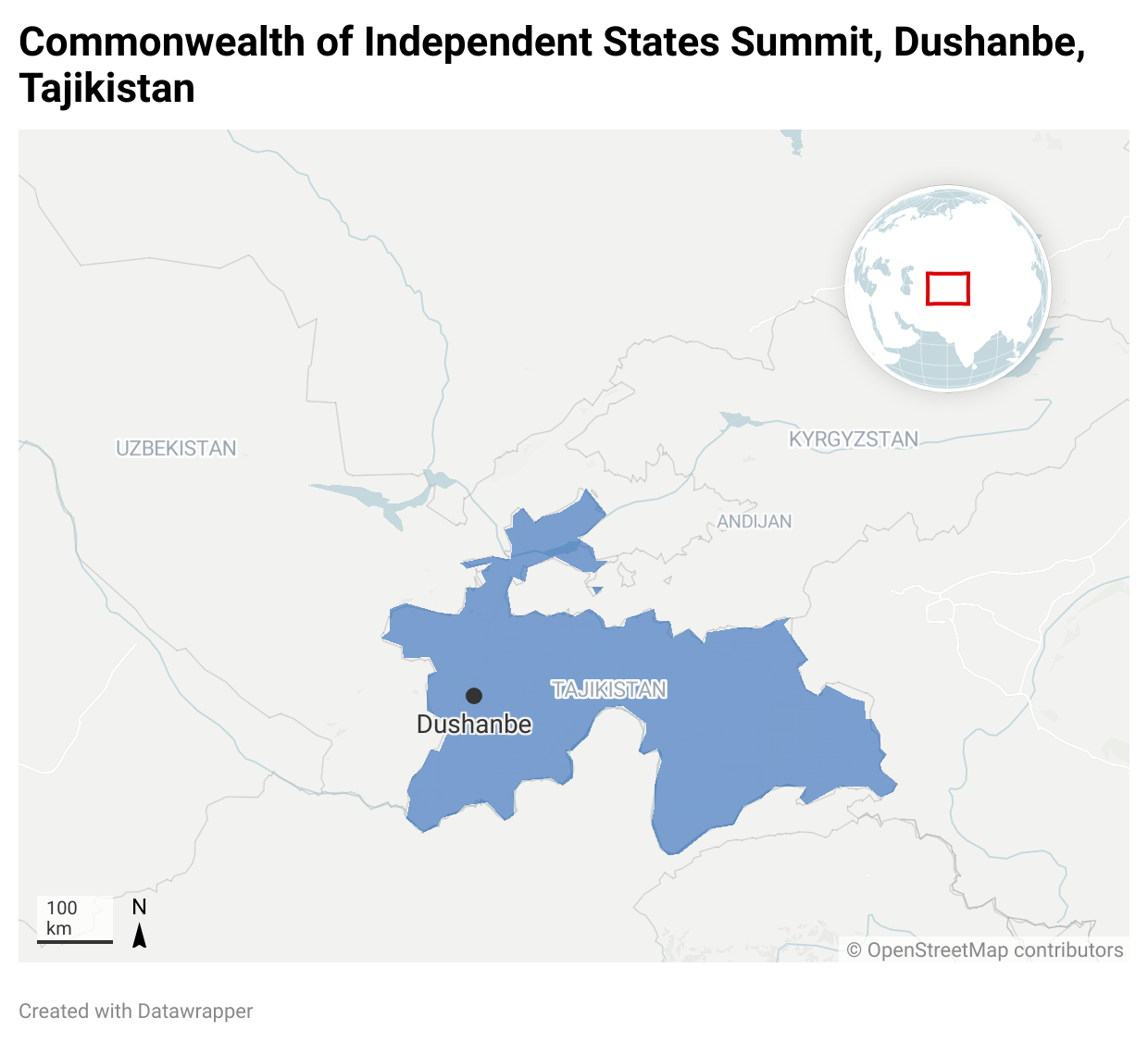

On 8 October, Russian President Vladimir Putin conducted a three-day visit to Dashunbe, Tajikistan, which included the Second Russia-Central Asia summit and a Commonwealth of Independent States (CIS) heads-of-state meeting. Discussions focused on critical regional issues such as migration, economic ties, trade and joint security initiatives. With foreign competitors, such as China and the EU, emerging as new regional partners and the impact of anti-Russian sanctions further incentivising Central Asia’s trade diversification, Moscow is increasingly concerned by its diminishing influence. During his visit, Putin reaffirmed the intent to reassert regional economic influence and urged higher levels of mutual trade and Russian investment. Crucially, he claimed that trade between Moscow and Central Asia had untapped potential due to the region’s large population in comparison to Russia’s other partners with similar trade levels, such as Belarus. While it is highly likely that Russia will hold a diminished economic and security leadership role in the long term, Moscow still maintains significant leverage due to Central Asia’s dependency on remittance earnings and migration policies.

Russia is struggling to maintain economic influence amid large-scale Chinese Belt and Road Initiative (BRI) investment and new EU trade and infrastructure initiatives, especially following the 2022 invasion of Ukraine and subsequent sanctions. In the first half of the financial year 2025 (H1), 45.55% of BRI investment, equal to approximately USD 24.3b, was allocated to Central Asia. Specifically, Kazakhstan was the single largest recipient of BRI investment, receiving USD 23b in 2025 H1. Comparatively, Putin recognised that Russia’s current investment of USD 20b across the region is inadequate.

Regardless, Russia maintains significant economic leverage as the key destination for Central Asia’s labour migration. In 2022, remittances accounted for 21%, 31% and 51% of Uzbekistan’s, Kyrgyzstan’s and Tajikistan’s GDPs respectively. Despite pressure from the 2022 Russian invasion of Ukraine, Central Asian labour migration into Russia grew by 60% in the first quarter of 2023. This has been critical to Russia’s wartime economy as significant labour shortages persist. Furthermore, many Central Asian migrants have faced conscription pressures, with almost 30,000 newly naturalised Central Asians registered for military service as of June 2024.

While facing international pressure to act on the International Criminal Court’s (ICC) arrest warrant issued against Putin, Tajikistan did not comply. During the summit, Dushanbe signed migration-focused agreements with Russia, aiming to develop a more secure environment for the approximately 1 million Tajik migrants to prevent mass returns and unemployment. Recognising the importance of an economic partnership with Russia, Kyrgyzstan and Uzbekistan also proposed establishing deeper transport and logistics cooperation to limit persistent trade and transit bottlenecks. The summit, therefore, called for increased comprehensive efforts to develop Eurasian international transport corridors and expand the North-South International Corridor’s capacity. However, the joint communique lacked specific details on how these initiatives would be achieved.

In terms of security, the CIS summit resulted in 19 agreements focusing on regional energy cooperation, a military cooperation concept through 2030, as well as counterterrorism and border security programs planned for 2026-2030. To ensure security and counterterrorism readiness, Russia plans to maintain its 201st military base in Tajikistan. However, the ongoing war in Ukraine is likely to limit the extent of Russia’s ability to maintain a strong security commitment in Central Asia. This is reflected in Russia’s earlier inability to exercise its intervening role in recent regional conflicts such as the 2022 Tajikistan-Kyrgyzstan clash.

Forecast

Short-term (Now - 3 months)

As the Russia-Ukraine war continues, it is highly likely that Central Asian states will continue pursuing alternative economic and trade opportunities with external partners. This is further reflected in the growth of the ‘C5+1’, as seen in the inaugural Central Asia-EU summit earlier this year.

Medium-term (3-12 months)

With the increasing geopolitical significance of Central Asia in global raw material and energy supply chains, more foreign partners are likely to compete with Russia’s economic presence in the region. For example, the EU’s Global Gateway investment package allocated EUR 12b (USD 13.99b) into regional connectivity, energy and digital infrastructure.

Long-term (>1 year)

Russia’s security guarantor role is also highly likely to face increasing pressure due to the resource strain caused by ongoing conflict in Ukraine. Therefore, it is unlikely that the establishment of new border outposts, under the 2026-2030 bilateral cooperation agreement with Tajikistan, will be significant in terms of scale.